Climate Change…an insurance wild card

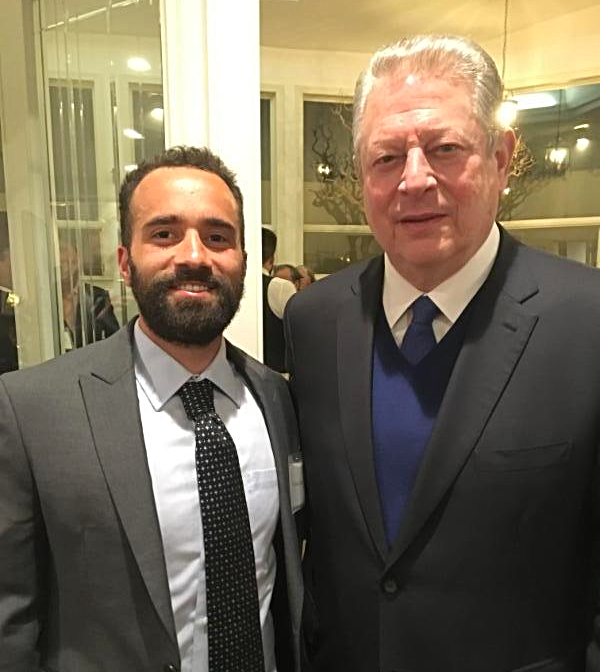

UP’s Andrew Cattell with Former Vice President Al Gore at the home of Tom Steyer and Kat Taylor who are supporting our wildfire recovery work in the North Bay, CA.

Wondering what you can do to keep your home insurance affordable in the face of extreme weather events?

Improving your property so it’s less likely to be destroyed in an earthquake, flood, hurricane or wildfire makes economic sense, and we think your insurance company should help and reward you for doing that. Some are, more should.

UP learned during our recent presentation with FEMA at the U.S. Treasury in Washington D.C. that every dollar invested in mitigation brings an average $6 return.

So whether you’re improving your roof, elevating your home, installing a flood vent, bolting your home to its foundation or maintaining defensible space around your home – your insurer should offer technical guidance and reward your investment with a break on your premium. Ask them in writing, and follow up with your state regulator if their answer is no.