Prepared, not scared

No, we’re not talking about doomsday predictions…

We’re talking about the simple things you can do to create your own financial safety net to prepare for extreme weather and what that weather can do to the roof over your head or your source of income.

We’re talking about the many ways United Policyholders is working to guide you toward that goal:

1. Follow the tips in this recent article in USA Today that features United Policyholders’ guidance and home inventory app.

2. Double check that your home or business is insured for what it would likely cost to replace it if it were to burn or be destroyed? Thanks to hard work by UP and Commissioner Dave Jones, California’s Supreme Court has ordered insurers to do a better job at insuring homes to value. The decision was a huge win for consumers, our organization, and appropriate regulation of insurance transactions in general.

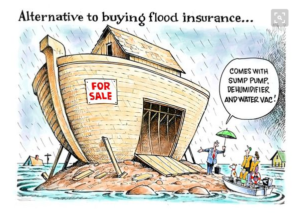

3. Don’t overlook how common it is for water to damage rentals, homes, businesses and their contents, and how much insurance policies vary as to what water damage they cover and exclude. Here’s great info to compare your coverage for non-flood water damage. Check out this excellent resource on flood damage. Remember: Just because your home isn’t in an officially designated flood risk zone doesn’t mean you shouldn’t carry flood insurance. If you can afford it, buy it.