What’s UP? December 2021

A message from Co-Founder and Executive Director, Amy Bach

Dear Friends,

As another challenging year draws to an end, I could not be more proud of our accomplishments or more grateful to our donors and volunteers.

In our 30th year of service, UP continues to score wins for consumers, help people solve financially crippling insurance problems and field a team of expert volunteers and staff that work hard every day to hold insurers to their promises.

Through our new and improved website and COVID-adapted Roadmap to Recovery operations in catastrophe-impacted regions, UP is helping thousands of people and businesses across the nation avoid and resolve stressful insurance problems. Our accomplishments are made possible with support from our generous donors, sponsors and powerful partners. Current partners include Fannie Mae, Financial Planning Associations, RCRC, State Insurance Regulators, Legislators and Community and other Foundations.

As consumers deal with the impact of the higher premiums and coverage reductions that insurers are putting into place in response to climate change, UP is working to put limits in place to preserve essential protections and reasonable pricing.

We battled hard this year for businesses crippled by COVID-19, filing a record-breaking number of “friend of the court” briefs, hosting moot courts and marshaling the resources of an expanded national attorney volunteer corps to counter the insurance industry’s coordinated campaign to avoid all responsibility despite having collecting billions in premiums for business interruption coverage before the pandemic.

Through our three national policy initiatives and advisory roles, we are making policyholders’ voices heard where it counts…at the highest levels of government, in state and federal courts and in the media. We are fighting for fair insurance practices and to protect consumers on many fronts.

“My home just north of Boulder, CO was a total loss from the Calwood fire on 10/17/20. As unprepared as I was for this devastating event, I soon found out I was just as unprepared for managing my insurance claim! I honestly do not know what I would have done without the help and support from United Policyholders.

“My home just north of Boulder, CO was a total loss from the Calwood fire on 10/17/20. As unprepared as I was for this devastating event, I soon found out I was just as unprepared for managing my insurance claim! I honestly do not know what I would have done without the help and support from United Policyholders.

The sharing of knowledge and support has been inspiring. As it has been said during many UP sessions, “your homeowners policy is only a vehicle which you still need to ‘drive’ to reach your destination.” In that case, UP has been the trusty navigator mounted on the dash, in that kind reassuring voice saying “please turn here, when convenient, make a U turn,” and finally, “you have reached your destination.” In other words, without UP, I would have certainly been “lost!”

– Extremely grateful, Kevin Mott, MD

- Roadmap to Recovery

- Advocacy and Action

- Roadmap to Preparedness

- UP in the News

- Thank you Donors and Funders

Delivering critical guidance, tools and support to victims of disasters

30 years of guiding and supporting people after disasters and building relationships with public and private sector partners has given UP the expertise and resources to be a trusted long term recovery leader and an asset to communities and individuals.

30 years of guiding and supporting people after disasters and building relationships with public and private sector partners has given UP the expertise and resources to be a trusted long term recovery leader and an asset to communities and individuals.

We are currently providing Roadmap to Recovery services in California, Colorado, Oregon and Washington and continued support to other disaster impacted regions including the Midwest, Texas and Puerto Rico. We’re ready for whatever 2022 may bring.

The shelter-in-place orders that required so many of us to get comfortable (maybe a little too comfortable) on Zoom enabled UP to fine-tune our virtual service delivery and give insured loss victims uninterrupted access to the answers and information they need. With enhanced tech capacity, we’re reaching more people who’ve had to relocate outside their original communities after disasters due to scarce housing options. We have also increased our capacity to educate and support non-English speakers by using translation services.

To learn about the menu of R2R services we’re currently offering, please continue reading…

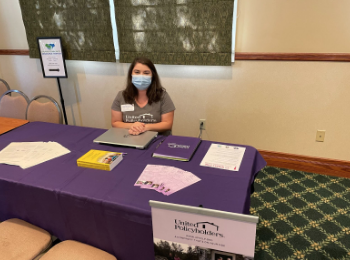

UP staffers Eva Nguyen (San Bernardino, CA) and Hallie Greene (Santa Cruz, CA) are regional “Local Coordinators” delivering UP tools and guidance at in-person wildfire recovery events.

Sharon Bard, 2017 Tubbs Fire Survivor, Team UP Volunteer on Self-Care After a Loss:::

“Be kind to yourself. It’s possible to acknowledge the huge loss and trauma while also being thankful for your life and the kindness around you. Lower the bar, notice the little steps along the way, and pat yourself on the back. You are a survivor”

Legislative progress on wildfire claim handling reforms

that ease recovery and reduce conflicts

Oregon

Oregon

UP Roadmap to Recovery partner and State Representative Pam Marsh (Oregon, District 5) represents over 2,000 households that were destroyed in fall 2020 wildfires. She is working hard to help them recover, and is helping her constituents access UP’s Roadmap to Recovery resources.

In addition to co-hosting and helping publicize UP workshops and pro bono legal help clinics, Rep. Marsh also shepherded and got a bill passed and signed by Governor Kate Brown that will improve the flow of insurance dollars to future wildfire victims. The new law gives people more time to access insurance benefits, more flexibility in replacing their homes and a better chance of being adequately insured. UP testified twice in support of Rep. Marsh’s bill and assisted in its passage.

Colorado

In July, 2021 Rep. Marsh and Executive Director Amy Bach gave a joint presentation on the bill to state lawmakers from across the United States at the National Council of Insurance Legislators summer meeting and encouraged others to adopt similar reforms in their states. To advance that goal, UP connected Rep. Marsh with Colorado State Assemblymember Judy Amabile (Colorado, District 13) who is now working with UP, Insurance Commissioner Mike Conway and other stakeholders to build on efforts to improve post-disaster claim handling in her state.

Washington

Commissioner Mike Kreidler recently adopted an important regulation supported by UP that prohibits insurers from reducing claim payments by unfairly depreciating the cost of labor.

Our goal is for all wildfire-prone states to implement similar laws that improve the flow of insurance dollars to finance repairs and rebuilding so there is one set of general rules for all to follow.

We are extremely grateful to the Center for Disaster Philanthropy for funding our work helping 2020 wildfire survivors in these western states. It is that “on the ground” work that allows us to identify common problems, create relationships with elected officials and propose advocacy changes to help all insurance consumers.

2021 Advocacy Initiatives

COVID-19 Loss Recovery Initiative

COVID-19 Loss Recovery Initiative

A UP working group, comprised of a distinguished group of the nation’s leading policyholder attorneys, is continuing to help affected businesses by weighing in on unfair virus exclusions and misleading policy language. Our goal is to defend policyholders rights for coverage during the pandemic.

Wildfire Risk Reduction and Asset Protection Project (WRAP)

Wildfire Risk Reduction and Asset Protection Project (WRAP)

UP’s WRAP working group developed wildfire mitigation standards to harden homes and is now working towards a pilot mitigation certification program to help homeowners reduce their risk and their rates and keep their insurance.

Restoring Insurance Safety Net Coalition (RISC)

Restoring Insurance Safety Net Coalition (RISC)

UP is battling unfair exclusions that insurers have added to protect their profits in light of climate change and calling on public officials across the country to step in. Through our RISC initiative, we are working to stem the tide of fine print that deprives loss victims of repair funds.

Amicus Project

Amicus Project

The United Policyholders Amicus Project helps preserve and enforce insurance promises – large and small – because lives and livelihoods depend on them.

If you live in a region that’s experiencing droughts, wildfires, flooding and/or hail or wind events associated with climate change, you’re probably paying alot more these days to insure your property with fewer insurers to choose from than in the past.

UP helps consumers shop and works to improve options for insuring property against natural disasters, but in recent years we’ve had to focus intensively on helping people in wildfire-prone regions where insurance costs have skyrocketed and insurers are not competing for their business.

In addition to gathering data through surveys and agent/broker volunteers to point consumers in the direction of possible options for keeping their assets protected, UP has taken a hands-on approach to helping property owners reduce risk (mitigate) and qualify for better pricing and/or avoid being dropped. There are state-sponsored mitigation and insurance reward programs for hurricane and flood risk, but none for wildfire risk. UP is working to fix that.

After a year of work, our Wildfire Risk Reduction and Asset Protection Initiative (WRAP) working group issued a list of 13 home improvement steps that should be the official standards for a wildfire prepared home. We are in the process of vetting our list with insurers and government partners.

We are seeing real progress in the number of insurers now offering discounted pricing for risk reduced homes and are hopeful that our working group’s list plus actions by the CA Dept. of Insurance, CalFire and the Institute for Home and Business Safety (IBHS) will keep the ball rolling. We were very pleased when IBHS recently announced a “Wildfire Prepared Home” designation.

Once official risk reduction standards and insurance rewards are in place, United Policyholders expects companies to resume insuring homes in brush areas, expand eligibility for coverage and offer discounts for “wildfire prepared” homes.

To read UP’s list of wildfire risk reduction home improvements, click here.

- IBHS’ Roy Wright has roots in CA and supports wildfire risk reduction

- 18 members of the WRAP working group – representing FireSafe Councils and other community organizations, joined UP comments on draft regulations related to Mitigation in Rating Plans and Wildfire Risk Models in California

Click here for highlights from our 30th anniversary event

and enjoy the photos below from our past anniversaries

- Celebrating 30 years of service at UP to Good 2021 in Sonoma, CA. UP honored the local organization Coffey Strong for their local leadership in disaster recovery,

- Board Member Susan Piper at UP’s 25th anniversary fundraiser.

- Former Oakland Mayor Jean Quan presents a proclamation to UP Board members at our 20th Anniversary event at City Hall.

- Fire survivor and Bay Area Consumer TV News reporter Betty Ann Bruno with then CA Insurance Commissioner now Congressman John Garamendi and E.D. Amy Bach at UP’s 10 year anniversary event.

UP’s Valerie Brown honored by CA Legislator as

“Woman of the Year”

If you’ve ever had a chance to meet Valerie Brown, you know she is an extraordinarily dedicated and compassionate social services expert who and cares about her community and yours!

If you’ve ever had a chance to meet Valerie Brown, you know she is an extraordinarily dedicated and compassionate social services expert who and cares about her community and yours!

That’s why we are so proud to have her as a Senior Program Officer at United Policyholders and not surprised when Assemblymember Brian Maienschein honored Valerie Brown as the 77th Assembly District’s 2021 Woman of the Year. Congrats!

At this 30 year milestone, we are again reminded of the immense gratitude we have for all of the donors, supporters and volunteers who have contributed to us over the years. We could not have gotten this far without you and we promise to do everything in our power to continue empowering consumers and promoting fair insurance practices for many decades to come.

We are grateful for the support from our foundation partners, Find Help Directory sponsors, event sponsors, and our individual and corporate donors, which to this point in 2021 has allowed UP to expand our services to meet the unique challenges of the time.

Our funders are supporting our virtual and in person wildfire recovery services across California, Colorado, Oregon and Washington. Other grant funding is providing UP with the ability to dedicate resources to help communities be more resilient and better protected when disaster strikes.

Special thanks to Merlin Law Group for supporting UP’s RISC project, a national research and advocacy campaign restore basic home insurance coverage and overcome fine print exclusions that are becoming more and more common and problematic.