Wildfire Risk Reduction and Insurability

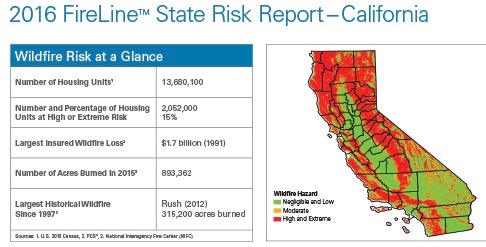

In the age of big data and GPS mapping, insurers are increasingly using complicated and opaque models to set their rates. FireLine is one name brand model created and sold to insurers by Verisk/Insurance Services Office. FireLine looks at a number of criteria (slope, access, fuel, fire history) and assigns a property a score. In many cases, this is the only criteria the insurer uses to determine premiums and which properties they will insure. The higher the score, the higher the premium. Too high of a score and you can’t get coverage at all. As a result, many residents in Wildland Urban Interface (“WUI”) zones in states such as California are finding their premiums skyrocketing and some insurers have left these areas altogether.

United Policyholders is engaging with stakeholders in these areas, including local and state government and community leaders to solve these problems. In California, UP intervened to challenge an insurer’s use of the FireLine score and is working with a task force and the Department of Insurance on fixing the affordability and availability crisis facing many homeowners through legislation. UP also offers guidance to homeowners in the WUI zone who have been non-renewed by their home insurer. UP recently petitioned the California Department of Insurance to take action and supports legislative proposals advanced by the Department.

Reports on this topic:

California Department of Insurance: “The Availability and Affordability of Coverage for Wildfire Loss in Residential Property Insurance in the Wildland-Urban Interface and Other High-Risk Areas of California: CDI Summary and Proposed Solutions” Published December, 2017

The RAND Corporation on “Insurance for Wildfire Risk in California” October 2018