Dropped by your home Insurer? Where to go for help in California

|

Please take a moment to complete our short CA Home Insurance Survey |

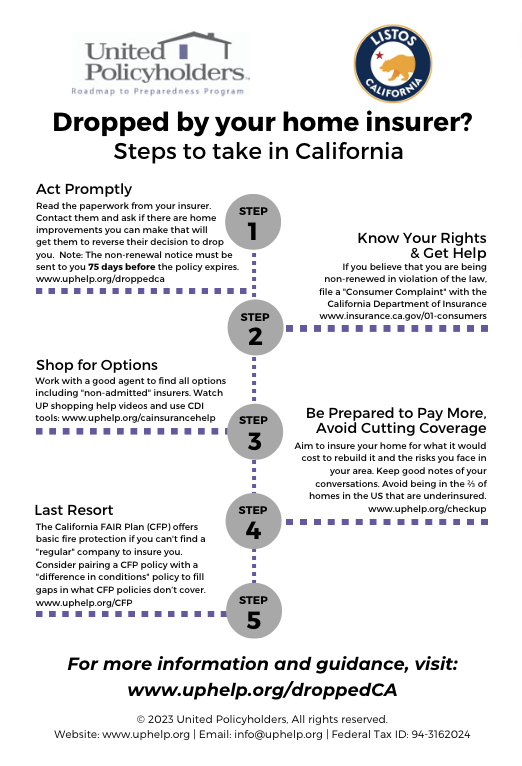

If you are one o f the many Californians whose insurance company had notified you they will not be renewing a policy on your home, don’t panic, but start shopping ASAP. In California your insurer must give a minimum of 75-days notice before your policy expires. You likely will need at least that much time to find a replacement policy you can afford.

f the many Californians whose insurance company had notified you they will not be renewing a policy on your home, don’t panic, but start shopping ASAP. In California your insurer must give a minimum of 75-days notice before your policy expires. You likely will need at least that much time to find a replacement policy you can afford.

In most parts of the state, you still have buying options and insurance companies are still competing for your business. But if you live in a brush-heavy or forested area that’s been hit by recent wildfires, it may be hard to find a company willing to insure your home. When you find a replacement policy, it will probably cost more but provide less protection than your old policy. It may be through a “non-admitted” insurer.* These types of companies are picking up customers that “admitted” (well-known brand) insurers are dropping.

United Policyholders is here to help you shop and deal with this unfortunate situation, and we are working on initiatives to fix it. To learn more about the reasons why so many insurance companies are reducing the number of homes they’re insuring in parts of California, visit our Advocacy and Action section.

1) TRY AND GET YOUR INSURER TO REVERSE ITS DECISION AND RENEW YOU**

Contact your current insurance company and ask them if there are improvements you can make to your home that will qualify you for a renewal. Give them your best arguments for keeping you as a customer. If you bought your expiring policy through an agent, ask him/her to go to bat for you with the company.

Contact your local fire department, Fire Safe Council or elected officials and find out if there is an inspection, fire risk reduction certification or brush clearing assistance program available in your area. Learn more about home assessments in your area here: www.uphelp.org/wrap

NOTE: If your insurer did not give you 75 days notice, or their reasons for dropping you seem unfair, seek help from the California Department of Insurance (CDI) at 1-800-927-HELP, www.insurance.ca.gov.

Limited circumstances where an insurer must renew your policy:

- You have a policy with a guaranteed renewal provision. A few companies offer this. Some AARP members who bought through The Hartford have this protection.

- You lost your home in a declared disaster within the past two years:

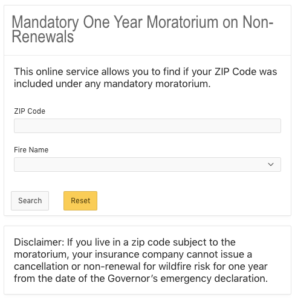

CA Insurance Code at section 675.1 gives disaster victims the right to two renewals when their policy comes up for renewal. - You live in a zip code adjacent to a recent wildfire. Use the CDI Zip Code Mandatory Moratorium Tool to see if zip code is protected.

Current Bulletins:

– December 9th, 2025 Declaration (Pack Fire)

– September 19th, 2025 Declaration (TCU Lightning Complex Fire)

– June 18th, 2025 Declaration (Franklin Fire)

To View Past Bulletins, Scroll to the Bottom of the Page. Past bulletins include:

2) DON’T PANIC, START SHOPPING

Contact the insurance agent you’ve been using, or ask trusted sources for recommendations to an “independent” insurance agent. Independent agents have relationships with multiple insurance companies. A “captive” agent that sells for companies like State Farm, Farmers or Allstate probably can’t help you, as they’re limited to only one insurance company.

Visit the Home Insurance Shopping Help page in the preparedness section of this website. You will find many resources to help you navigate finding insurance in a challenging marketplace including publications and webinars.

Try the California Department of Insurance’s shopping tools. They offer a list of CA home insurance companies with toll-free phone numbers, and a list of companies that sell “DIC” (“Difference in Conditions”) policies that fill gaps in Fair Plan policies. www.insurance.ca.gov

If your best coverage and price option is through a “non-admitted” (also called “surplus lines”) insurance company, check their financial strength rating with Demotech, A.M. Best, or another agency before you buy. This is important. If a non-admitted insurer runs out of money to pay claims, (becomes “insolvent”) their customers are not protected by the same safety net*** that “admitted” well-known brands have under them, and the CA Dept. of Insurance has less oversight power over them. For more info, read, How to Check an Insurer’s Financial Strength.

3) SHOP SMART

Your policy should cover what it would likely cost to rebuild your home in compliance with current building codes if it were to be completely destroyed by a natural or manmade disaster of any kind. But many policies don’t. Don’t blindly trust that your agent or insurer is selling you a policy that will fully protect your assets. UP surveys show that 2/3 of U.S. homes are underinsured. Shop for a policy that will adequately insure your dwelling for a total loss fire, (including building code upgrades) then add coverage for flood and quake protection if you can afford it. Ask the right questions and take good notes while shopping.

- Aim to insure your property for Replacement Cost Value, not depreciated Actual Cash Value.

- Coverage for building code upgrades and an extended replacement cost rider are worth paying for.

- Your dwelling coverage limit should match local construction costs (per square foot) for a home of similar style, age and quality, plus an “extended replacement cost” feature for extra protection.

- Choose the highest deductible you feel comfortable with to keep the cost of your coverage manageable.

4) THE FAIR PLAN IS A LAST RESORT

If you strike out in the “normal” marketplace, you can buy home insurance through the California Fair Plan. Call them at (800) 339-4099). www.cfpnet.com Please review our latest tips on insuring your home through the Fair Plan and supplementing the limited protection they provide by buying a “Difference in Conditions” policy in addition.

The CA FAIR Plan is a state-run home insurance program for people who can’t find a better option. Fair Plan policies provide only basic fire protection (no liability or theft) and cost more than a traditional policy. If you end up having to buy a Fair Plan policy, we recommend two things: Shop again in 6 months. New options may be available. And, if you can afford to, add supplemental coverage for what a Fair Plan policy excludes.

Not all insurance agents are familiar with these options, so visit http://www.insurance.ca.gov/01-consumers/105-type/5-residential/carriersDICpolicies.cfm for more info.

For more shopping help guidance, visit: www.uphelp.org/cainsurancehelp

Past CDI Moratorium bulletins include:

November 7th,2024 Declaration (Mountain Fire)

November 1, 2024 (Shelly Fire, Bear Fire)

September 29th, 2024 Declaration(Boyles Fire)

September 7th & September 11th, 2024 Declaration (Line Fire, Bridge Fire, Airport Fire)

July 26 & July 30, 2024 Declaration (Gold Complex Fire, Park Fire, Borel Fire)

July 3rd, 2024 Declaration (Thompson Fire)

August 29, 2023 Declaration (Smith River and Happy Camp Complex Fires)

November 19, 2022 Declaration (Route Fire)

September 19, 2022 Declaration (Mountain, Barnes and Fork Fires)

September 8, 2022 Declaration (Fairview and Mosquito Fires)

September 2, 2022 Declaration (Mill Fire)

July 30, 2022 Declaration (McKinney and China 2 Fires)

July 23, 2022 Declaration (Oak Fire)

July 1, 2022 Declaration (Alisal & Colorado Fires)

July 2021 CDI Bulletin

November 2021 Bulletin

Aug. 2020 CDI Bulletin

2019 CDI Bulletin for specific zip codes that are protected

*“Admitted” insurers are fully regulated by the CA Department of Insurance and their customers are protected by CIGA, the CA Insurance Guarantee Association if their insurer becomes insolvent (runs out of money). “Non-admitted” insurers are not.

**With a few exceptions, your insurance company can drop (non-renew) you as long as they give you written notice at least 75 days prior to the date your old policy will expire, and as long as they are following their own guidelines and not discriminating against you. Their guidelines must be objective, have a substantial relationship to the risk of loss, and be applied consistently. Common reasons include wildfire risk, the age or condition of the property, lack of defensible space, type of roof or construction. The 75-day notice must contain the reason or reasons for the nonrenewal, the telephone number of the insurer’s representatives that handle consumer inquiries or complaints, and a statement that you can have the insurer’s nonrenewal decision reviewed by the CDI.

***CIGA – the CA Insolvency Guarantee Association pays up to $500k per home if the insurer goes insolvent.