Building Code, Ordinance or Law Compliance

The purpose of this publication is to explain how the costs of complying with local and state building codes factor into property insurance claims.

BUILDING CODES RELATED TO HOME REPAIRS, REMODELS OR NEW CONSTRUCTION

Over the course of the time you’ve owned your home or other real property, the state and local building codes[1] have very likely been updated to current health and safety and energy efficiency standards. Commonly required upgrades include updated electrical and plumbing systems, foundations, roofs, energy efficient windows, fire sprinklers, and solar panels.

When they update building codes, enforcement agencies generally don’t require residential property owners to bring their existing properties up to the new standards unless they’re doing repairs or remodeling. When a property owner applies for a permit to make repairs or do a remodel, they are expected to make upgrades to meet current codes. When a property owner applies for a permit to build a new structure, their application will be rejected if the plans for the work are not in compliance with current codes.

Depending on where you live and how strictly building codes are enforced in your area, code compliance and code upgrades can add very substantial costs to a project, even if the damaged or destroyed structure was relatively new. Insured loss victims want their insurer to cover code upgrade costs as part of the necessary costs of restoring or replacing the damaged or destroyed structure. However, unless the policy includes coverage for improvements related to building code compliance, insurers will balk at paying for them, and the property owner must cover them out of pocket.

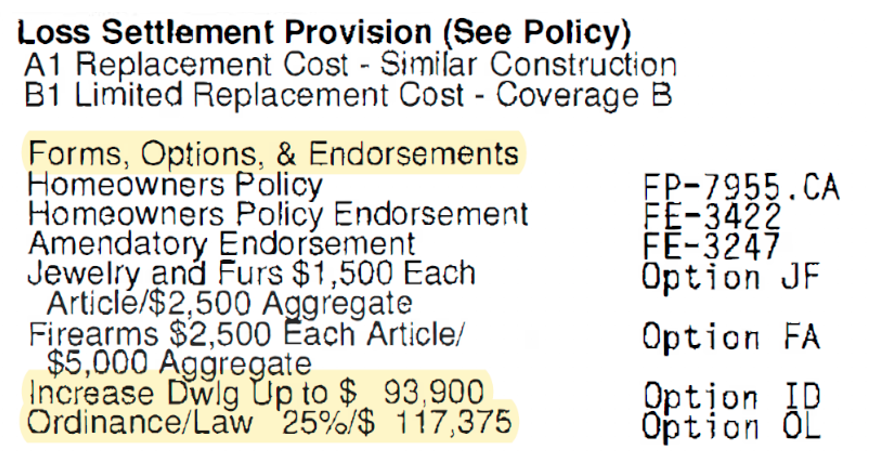

Code upgrade coverage can be included in the policy or provided via an endorsement or rider. Code compliance and upgrade coverage is usually shown as a percentage of the Coverage A – Dwelling limit – typically 10%, 25%, or 30%, etc. This limit applies only to the cost of the work you are required to do by state or local regulations.

YOUR POLICY MAY OR MAY NOT COVER CODE UPGRADES

Review your declarations page and the policy fine print to see if you have this coverage. Not all policies list code upgrade coverage in the same way. A common way you will see it listed is under “Additional Coverages” and titled “Ordinance or Law.”

Diligent agents and brokers recommend that their customers buy a code upgrade coverage endorsement or rider, and at least two states have made that recommendation a legal requirement. An increasing number of homeowner policies now contain an endorsement that adds coverage for upgrades required to bring your damaged or destroyed property up to current building code standards.

INSURERS ADVERTISE REPLACEMENT COVERAGE BUT BALK AT PAYING FOR “BETTERMENT”

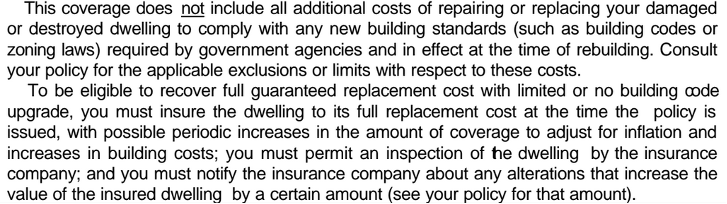

Code upgrades can also be expressly excluded through policy language such as this example:

Because a property owner cannot legally repair or replace a structure without complying with building codes, insurers should not be selling policies labeled as “Replacement” policies unless the policy covers the cost of replacing what’s insured. But insurers continue to do so. If your policy was labeled and sold to you as a “Replacement Cost” policy, but your insurer is refusing to cover the cost of improvements required by current building codes, United Policyholders recommends pushing back by “Speaking UP”, using leverage and negotiating to reach a fair resolution.

A LOCAL BUILDER CAN HELP YOU BREAK OUT AND DOCUMENT CODE UPGRADE COSTS

If your policy does not exclude the cost of required code upgrades or expressly covers those items but with a cap or limit, the company adjuster should include those costs in their dwelling loss estimate and settlement offer to you. If a dispute arises over that estimate, UP recommends getting a second (and third, if possible) dwelling loss estimate to compare with the insurer’s calculations. Breaking out and separately documenting Code Upgrades is often required to reach agreement with an insurance company adjuster. UP offers a sample of a Code Upgrade estimate here.

[1] Building codes are also sometimes referred to as laws, ordinances or regulations. For our purposes, those are all the same thing. When we use the word “code,” we’re referring to any official rule applying to buildings, regardless of whether it’s labeled as a code, law, ordinance or regulation.