Spooky home insurance changes to watch out for

Opening emails or letters from your home insurance company these days can be pretty scary. Non-renewals and premiums are increasing, and it’s trickier these days to find affordable coverage through a reputable insurer. UP is staying on top of the marketplace changes, keeping our shopping tips updated, and working on many fronts to advance solutions.

Opening emails or letters from your home insurance company these days can be pretty scary. Non-renewals and premiums are increasing, and it’s trickier these days to find affordable coverage through a reputable insurer. UP is staying on top of the marketplace changes, keeping our shopping tips updated, and working on many fronts to advance solutions.

Whether you’re spooked by how much your premiums have increased or scared you won’t be able to stay protected, we’ve got home insurance shopping tips to help you navigate today’s unprecedented marketplace conditions. And we’ve got a national corps of expert volunteers and sponsors who are out there helping consumers every day.

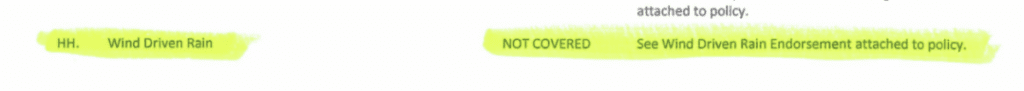

What’s keeping us up at night? People getting priced out and going bare, high deductibles and fine print exclusions causing claims to be closed without payment. Here’s an example of important coverage that got carved out in a Florida policy:

Also, more and more homeowners, HOAs and businesses are having to turn to insurers of last resort that offer limited coverage, or lightly regulated “non-admitted” (surplus/excess) companies. Non-admitted insurers historically covered only unusual risks, but today, they’ve been picking up properties admitted insurers will no longer cover. State insurance regulators have limited power over their products and rates. Non-admitted insurers don’t participate in insolvency protection programs. So before you entrust your assets to a non-admitted insurer, research their financial strength and tap the expertise of a reputable broker. UP is urging regulators to increase oversight of this type of insurer.

If you find protection gaps in your policy, snap a photo of the wording and send it our way! Email: policies@uphelp.org