WRAP UP: The Wildfire Risk Reduction and Asset Protection Project

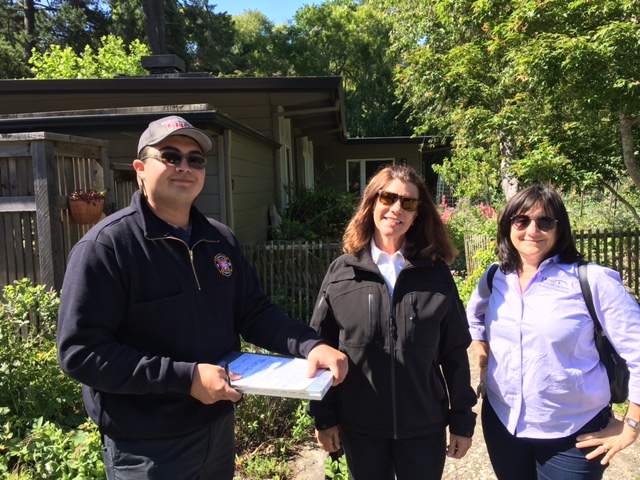

Above, R to L: After his insurer threatened to drop him, a Moraga, CA homeowner contacted his local Fire Dept. for help. UP’s Amy Bach rode along with local fire officials as they inspected and prescribed steps to reduce risk and retain his coverage.

If you make improvements to your home so it is less likely to be seriously damaged or destroyed in a wildfire, it’s only fair that your insurance costs should reflect that reduced risk…or at the very least, you should be able to find and keep affordable home insurance. But as things stand now, there are no official wildfire risk reduction standards in place for existing structures, and no regulations or laws that require insurers to adjust their rating or underwriting practices to incentivize or reward property owners that invest time and money into hardening their homes and reducing and clearing brush around their homes and in communities.

There are home hardening and risk reduction support programs, limited grants and mandatory premium discount laws in place in a number of hurricane and flood-prone regions. But when it comes to wildfires, insurers are not required to assist or give discounts to those willing to invest time and money into hardening their homes, clearing brush and maintaining defensible space. And, there currently is very little to prevent insurance companies from dropping or refusing to insure customers in rural and suburban brush heavy regions, even after those customers have invested time and money into reducing their home’s risk of being destroyed in a wildfire. In California there are fire-related building codes that apply to new construction, brush-clearing ordinances in individual communities and state-wide defensible space requirements. There is one program in the State of Colorado that a number of insurers are participating in: Wildfire Partners, but it is limited in scale and to date has not been replicated.

There are many communities running their own local programs, working through Fire Departments, FireSafe Councils and/or the Fire Wise program to clear brush and help residents be pro-active. But until we establish officially sanctioned wildfire risk home improvements and an inspection and completion certificate program, insurers will continue to non-renew and reject customers and insurance availability and affordability will remain a serious challenge for rural and Wildland/Urban Interface regions in wildfire-prone Arizona, California, Colorado, New Mexico, Washington and Oregon.

United Policyholders’ Wildfire Risk Reduction and Asset Protection Project (“WRAP”) aims to help create the standards, financial assistance, inspection and certification programs, and insurance rewards in the State of California that will reduce the underlying risk of wildfires and help restore a competitive home insurance market. Once we get this done in California, we can work in other states toward the same objective. We all know that people are far more likely to pro-actively reduce their wildfire risk if they know that will lead to them being able to continue insuring their assets at a reasonable cost. And we all know that wildfire severity and risk are increasing with climate change, and we need everyone to do their part to adapt. Getting insurer cooperation and participation is essential to increasing wildfire resiliency in Western states.

We have been proposing legislative solutions to this problem since 2017 and are continuing to work with lawmakers and other stakeholders to advance constructive solutions.

You generally can’t force an insurance company to keep you as a customer, but you should be able to mitigate your fire risk so they will.

What does “hardening” and “mitigation” mean in this context?

“Mitigating”, “hardening” and “fortifying” are words used to describe taking actions that reduce the risk of a structure being damaged by weather and other events. Wildfire risk reduction techniques include:

- vent screens that keep flying embers from entering a home

- creating “defensible space” by removing bushes and trees from around the perimeter of a structure

- fire-resistant building materials on roofs and exterior walls

- applying fire resistant foams/gels/chemicals to the exterior of a home

- double-paned windows

- sprinkler systems

What is UP doing to help homeowners reduce risk and keep insurance affordable?

We are working with the CA Department of Insurance, Firefighters, Public Officials, FireSafe Councils, Insurers, and other stakeholders to create workable mitigation guidelines, inspection and assistance programs, and rewards. Firefighters know a lot about maintenance and improvements that allow homes to survive wildfires. Our goal is for insurance companies to use that knowledge plus their expertise and resources to assist and partner with – not punish – their customers who live in brush areas.

We are working at the federal level to advance mitigation and insurance support/reward programs across the country. Our role as a consumer voice at the National Association of Insurance Commissioners and the Federal Advisory Committee on Insurance gives us channels to do this work.

In May 2020 we launched a “WRAP” Group to build consensus among stakeholders and accomplish our goal. For details click here.

Why are mitigation support and insurance rewards so important?

Climate change, the drought, insect infestations, tree-mortality, data-mining, and aerial surveillance technology have all combined to give insurance companies a serious case of the jitters about continuing to insure homes in brush areas. They are dropping long time customers, avoiding entire regions, and imposing steep surcharges and rate increases on the customers they’re still willing to insure. This is creating an affordability and availability problem for residents of brush areas throughout California and other states as well.

Elected officials turned to United Policyholders (“UP”) for help in 2016 because of our wildfire and insurance expertise and our success solving similar challenges in the past. We began factfinding and relationship-building and accepted the invitation to join an Insurance Working Group that’s part of a Tree Mortality Task Force (TMTF) that CA Governor Brown created to tackle the 102 million dead trees in his state. UP is engaged in ongoing work to promote mitigation and resiliency initiatives, including legislative approaches.

The problem is most severe for fixed income households that can’t afford to make mitigation improvements or pay higher premiums, but need to stay insured. There are lots of printed materials that alert homeowners on wildfire risks. What people need is guidance and help making improvements that harden their homes and satisfy insurance company underwriters that it acceptable risk to insure. Insurers need standards to guide their business decisions and the steady hand of public officials to calm their jitters.

According to a recent UP statewide survey of over a thousand homeowners, 80% said their insurance company has not made any suggestions for home improvements to reduce risk, insurance costs, or keep their coverage in place. 20% reported that they are struggling to pay for their home insurance.

Giving property owners incentives and support so they can be proactive in making their homes resistant to wildfire damage makes communities more resilient. Keeping insurance companies in the business of doing what they do best – assuming risk in exchange for profit – makes communities financially healthy. Let’s do this!

United Policyholders is grateful to AT&T for the 2016 grant that launched this project.

Donate here to support our Wildfire Mitigation and Insurance Project.

Further Reading and Additional Resources: Click Here

- Wildfire Risk Reduction and Insurability

- USAA/Firewise Discount

- Tree Mortality Task Force

- 2017 California Home Insurance Survey

- Wildfire Partners

- Fire Safe Council of Nevada County

- Commissioner predicts shrinking insurance options for CA homeowners

- Wildfire Safety and Recovery Act – SB 824

- Department of Insurance Whitepaper on Availability/Affordability

- IBHS Wildfire Codes and Standards: A State-by-State Reference Guide (Nov 2019)

- IBHS Suburban Wildfire Adaptation Roadmaps

- NAIC CIPR Mitigation Workshop

- California Department Of Insurance Echoes Black Swan’s Call For Transparency In Wildfire Risk Assessment