2018 Advocacy & Action UPdate

Bach Talk: An energized team UP

UP has been “all hands on deck” since last year’s hurricanes and wildfires. To deliver our Roadmap to Recovery™ services to the many impacted regions, we re-energized volunteers and partnerships and made major improvements to our online help libraries.

When insurers meet the reasonable expectations of their customers by paying policy benefits in full and on time, people, businesses and communities can bounce back after catastrophes. Making sure that happens is the heart of UP’s work through all three of our programs.

Our recent work has helped secure:

Because disasters draw public and media attention to insurance problems that need fixing, they give us Advocacy and Action opportunities. They open channels for UP and our partners to improve the flow of insurance dollars to current and future victims and reduce inefficiencies, costs and frustration all around.

Running simultaneous public programs in five disaster-torn regions would challenge any non-profit, let alone a small one with a big mission. We are meeting the challenge with determination. A BIG thank you to the individual, corporate and foundation supporters, volunteers and partners who’ve helped us get this far. We remain hopeful that charitable foundation support will allow us to stay the course through the long term recoveries.

- COO Emily Rogan, UP honoree Hon. Dave Jones, ED Bach and Staff Attorney Dan Wade

- Cammy Blackstone (AT&T) with Emily Rogan and UP’s newest team member Andrew Cattell

Advocating for consumers in Congress and state legislatures:

UP helped draft legislation in many states, including supporting pro-consumer legislation in Congress, New York, Montana, California, Texas, and Arkansas.

Highlights Include:

- Montana is using the UP/Rutgers Essential Protections for Policyholders to prohibit insurers from using zero-dollar claims as a basis for non-renewal or premium surcharge.

- California is taking action to tackle the availability and affordability issues faced by many homeowners in rural areas thanks to UP’s work with the Governor’s Task Force on Tree Mortality and the California Department of Insurance.

- UP continues our fight for reforms to the National Flood Insurance Program to improve claim settlements for flood victims and provided bill language to Senators.

Fighting for fairness in the home insurance marketplace

UP Intervened on behalf of consumers in a California Department of Insurance rate increase proceeding with CDI which resulted in a significant rate decrease for policyholders.

UP Intervened on behalf of consumers in a California Department of Insurance rate increase proceeding with CDI which resulted in a significant rate decrease for policyholders.

UP Petitioned the CDI to be more proactive in addressing the growing availability and affordability challenges facing homeowners throughout CA and curbing insurers’ inappropriate use of computer models to drop long time customers.

Amicus Update

In 2017 we filed 25 Friend of the Court Briefs on behalf of policyholders and celebrated major victories in the Pennsylvania and California Supreme Courts. This year we weighed in to protect Long Term Care insurance buyers from unfair rescissions, and are preparing briefs on ERISA appeals, the improper depreciation of labor and the scope of insurance appraisals.

Highlights include:

- Pennsylvania: PA’s highest court adopted UP’s arguments and upheld legal remedies for consumers who’ve been treated unfairly by insurers in that state. (Rancosky v, Washington National)

- Georgia: Breach of the duty to settle = insurer pays excess verdict in GA. When an insurance company fails to help its insured resolve a lawsuit that’s been brought against him or her, it is responsible for the consequences. (Nationwide v. Camacho)

- California: An insurer must pay cost of repairs, not the [lower] fair market value. An insurer cannot exploit a vulnerable insured and take advantage of depressed real estate conditions by paying less than what’s owed to repair a damaged home.(California Fair Plan v. Garnes)

- Texas: The highest court in Texas protected policyholders’ rights to obtain information from insurance companies during litigation discovery. (In Re State Farm Lloyds)

- California: The highest court in CA cited UP survey results and sides with consumers in supporting regulations to reduce the incidence of disaster victims finding out they’re severely underinsured (Association of California Insurance Companies v. Dave Jones)

Thank you Juliette Bleecker (SFTLA) for partnering with UP to host pro bono clinics for wildfire survivors

SF attorney Lee Harris is a generous UP volunteer, answering Ask an Expert questions and supporting the Roadmap to Recovery

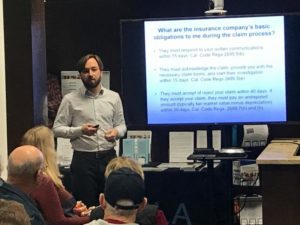

Staff Attorney Dan Wade presenting at a legal help clinic for fire survivors co-hosted by UP and three partners

Prof. Jay Feinman, Rutgers Law School and UP partner on EPP, Bach and John Buchanan of

Covington Burling at the ALI

THANK YOU

Our Amicus Project would not be possible without help from our generous volunteers who donate countless hours of valuable expert attorney time drafting our briefs pro bono. UP thanks all Amicus Project volunteers!

For more information on the Amicus Project and to view all UP amicus briefs filed this year, visit our Amicus Library.

Your support provides free access to experts, tools, and resources to disaster survivors nationwide so they can get home sooner.