When the chips are down, there’s UP

Educating, Advocating and Empowering

through the Pandemic Years

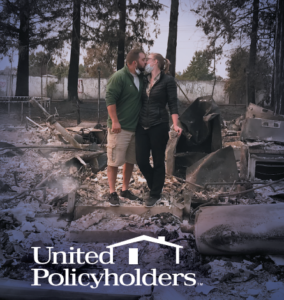

UP continues to innovate during the pandemic to provide Roadmap to Recovery® services in person where safe, and through virtual channels to support disaster-impacted households and communities and be a powerful advocate for consumers across the nation.

UP continues to innovate during the pandemic to provide Roadmap to Recovery® services in person where safe, and through virtual channels to support disaster-impacted households and communities and be a powerful advocate for consumers across the nation.

Our COVID adaptation has allowed us to provide more services to more people than ever before. Using technology to reach people in remote areas and make it easier for our volunteers to stay engaged has boosted our capacity to be helpful and impactful.

Help us help Kentucky tornado-impacted households on the road to recovery that lies ahead

While the pandemic had a profound impact on so much of our world, natural disasters did not stop, and the need for our unique services remains greater than ever. As we continue supporting and guiding wildfire-impacted households in four states, we also need to provide Roadmap to Recovery® services to devastated tornado survivors in Kentucky, and those who’ll be hit by severe weather events this winter.

Since March 2020, we have added two new UP service delivery models and assisted households impacted by more than 35 natural disasters across the United States.

- We are proud of our uninterrupted service delivery during the COVID-19 pandemic.

- A Team UP volunteer paying forward the help he got after a wildfire by helping others at a Local Assistance Center in NorCal

UP’s most recent offerings have included:

- 43+ Roadmap to Recovery “How to” Workshops

- 42+ Question and Answer Webinars

- 27+ Survivor to Survivor Forums

- 18 Disaster Recovery Help Libraries

“Without the knowledge and encouragement from UP, I would not have received $68,000 (the last 25% of personal contents) through my persistence and detailed questions. Plus there was another $100,000 left in the RC bucket of money and Code Upgrades bucket that I would not have had an opportunity to receive.”

— Ellyn A., 2018 Camp Fire survivor

Advocating for insurance fairness on COVID losses

When official public safety and shelter-in-place orders went into effect, UP knew that insurance benefits would make or break businesses’ ability to resume operations and recover. So when we got early reports that insurers were denying all COVID-19 business interruption claims across the board regardless of actual policy wording and with little to no investigation, we knew we needed to swing into action. UP formed a COVID BI Loss Recovery Working Group, a distinguished group of the nation’s leading policyholder attorneys, and for over a year have been coordinating to fight for the coverage that businesses paid for and so desperately need to recover from pandemic interruptions.

Our volunteers have donated thousands of hours drafting friend of the court briefs, participating in semi-monthly meetings moderated by our staff, hosting moot courts and participating in oral arguments. We are deeply grateful to the outstanding group of lawyers who’ve come together under UP’s umbrella to uphold consumers’ reasonable expectations of coverage and preserve the principles and precedents that are critical to a fair insurance system.

Sadly, by convincing courts across the nation that the entire insurance industry will go under if they’re forced to pay their customers’ COVID business interruption claims, insurers have succeeded in preventing the majority of claims from even being heard. In the process of making results-oriented decisions, courts have upended decades of case law requiring insurance policies to be interpreted fairly and to effectuate indemnity in case of loss.

With help from our outstanding volunteer corps, UP will continue to battling in State and Federal courts. Onward and UPward!

Resiliency and Climate Change Adaptation

Climate change is creating a “new normal” of more frequent and severe natural disasters. Insurance companies are responding by taking care of themselves and their profits. UP is focused on taking care of you and your financial wellbeing by spearheading two important initiatives:

The Wildfire Risk Reduction and Asset Protection Project (WRAP) working group developed mitigation standards to harden homes and is now creating a pilot mitigation certification program to help homeowners reduce their risk and their rates and keep their insurance.

The Restoring the Insurance Safety Net Coalition (RISC) national initiative identifies coverage gaps in insurance policies that are harming consumers by reducing the value and shrinking coverage for disaster damage to homes.

Our advocacy initiatives helped improve resiliency and preparedness across the U.S., including:

- Insurance shopping help available at www.uphelp.org

- Providing the straight scoop on insurance to national and local media outlets, including NPR, New York Times, Consumer Reports, Fox Business, U.S. News and World Reports, USA Today, National Law Review, Money Magazine, Forbes, Los Angeles Times, San Francisco Chronicle, The Tampa Bay Times, The Santa Rosa Press Democrat

- Filing 72 Amicus Briefs in courthouses in 27 states, including 45 related to COVID-related business losses

- Testifying on state legislation to protect insurance consumers’ rights in Oregon and Massachusetts

Helping residents of wildfire-prone states reduce risk and keep affordable insurance on their homes through our WRAP project and a certification pilot project in San Diego County - Helping California residents be prepared for earthquakes (LISTOS Project)

- Providing disaster and insurance preparedness education to homeowners and renters who live in high danger areas across 6 wildfire prone counties in Colorado.

Thank You to our donors, funders, partners & volunteers!

Thanks to your support, UP has maintained and expanded services during this unprecedented time. The emergence of a global pandemic has not changed the need to get disaster survivors the help they deserve or to prepare for future disasters.