With the exception of a health insurance policy, where a high deductible can give you pain in the pocketbook all year long, raising the deductible in your home, car, business, or renter’s policy is smart insurance math. A higher deductible lowers the cost of your insurance. It also makes economic sense in the current environment where insurers are penalizing policyholders who file claims by increasing their premium or dropping them… even for losses that were not the consumer’s fault. Unfair as this is, efforts by regulators and legislators to impose reasonable limits on these penalties are still a work in progress. So for now, we recommend the following:

Raise your property insurance deductible to the highest amount you feel comfortable with. For home or renters policies, we recommend at least $1,000. There’s no harm in getting quotes for a deductible as high as $5,000 to see how much it brings down the premium. For your auto insurance, we recommend raising your deductible and using part of the savings to increase your UM/UIM protection.*

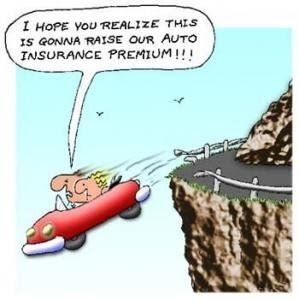

Yes – you pay for your insurance; you should have the right to use it without a penalty. But do the math before you file a claim– if the loss is under your deductible, don’t file it, pay it out of pocket. Clean record = lower premiums.

If you’ve been good this year (for goodness sake), don’t forget to add high value gifts to your UP Home Inventory.

This, and all our monthly tips are our gift to you and your wallet. Warmest wishes and a happy and healthy New Year to one and all! Team UP

*Your chances of getting into an accident with an uninsured driver are much higher than you’d think (According to one industry study, 1 in 7 drivers are driving “bare”).