A New Option for Disaster Insurance: Parametric

There’s a new option available for disaster insurance called Parametric. Parametric policies make payouts based on the occurrence of a data measurement (a “parameter”), as opposed to a claims adjustment process. The main advantage of parametric is speed of payment. Payments from parametric policies can be disbursed as soon as the next day, which is especially important after a natural disaster.

Another difference is that parametric payments typically cover many types of expenses, including the cost of disruption, even if you don’t have physical damage to your property.

Parametric could make sense whether you’re a homeowner or a renter, and whether you already buy conventional disaster insurance or not. If you don’t yet buy conventional disaster insurance, parametric can cover some of your first expenses at a lower cost than conventional disaster insurance premiums. And if you already buy conventional disaster insurance, parametric can cover part of your deductible.

Examples of parametric or partly-parametric insurance include:

For earthquake in California: Jumpstart

For wind in Florida: StormPeace

For flood in the UK: FloodFlash

Let’s look closer at the difference between parametric and conventional insurance policies.

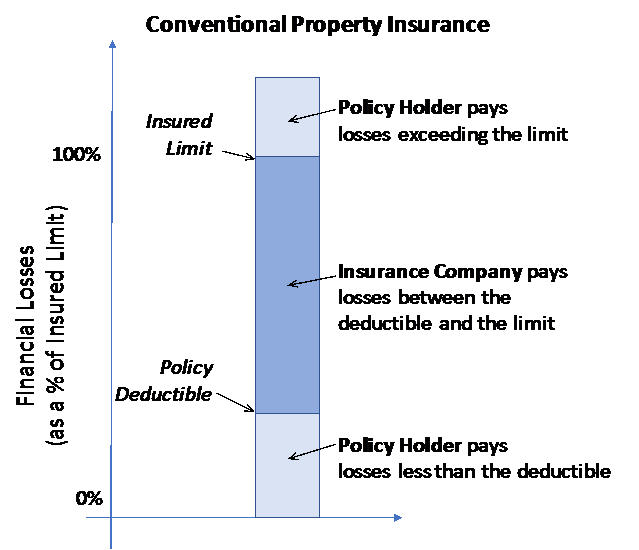

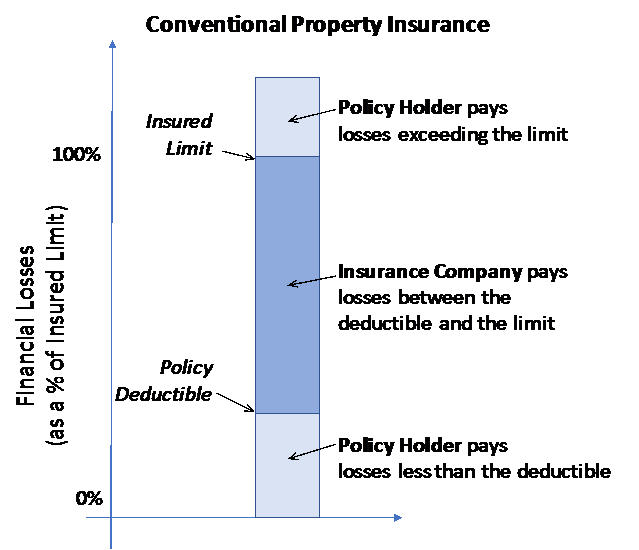

Conventional Property Insurance

A conventional property insurance policy works as shown in the diagram below. The insured limit is the stated replacement value of the property, and there is a deductible. The policyholder pays the first losses up to the value of the deductible, and the insurance company pays losses exceeding the deductible, up to the limit.

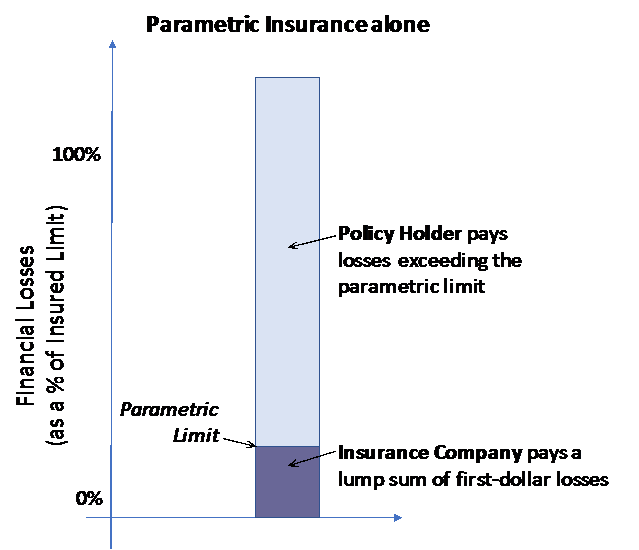

Parametric Insurance

A parametric policy, on the other hand, pays first-dollar losses, in a lump-sum.

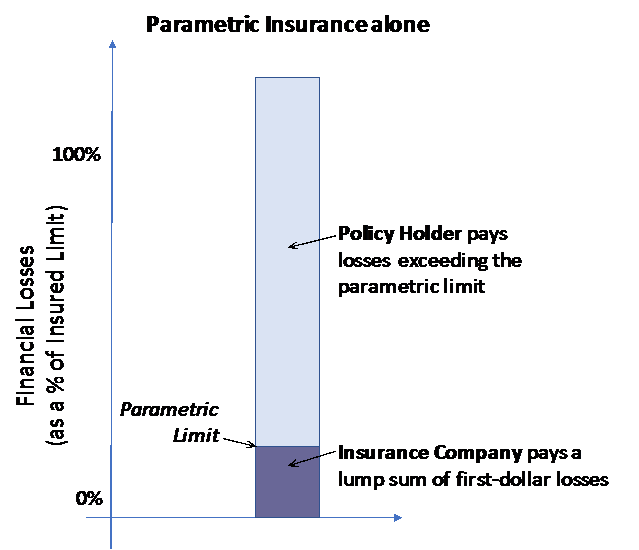

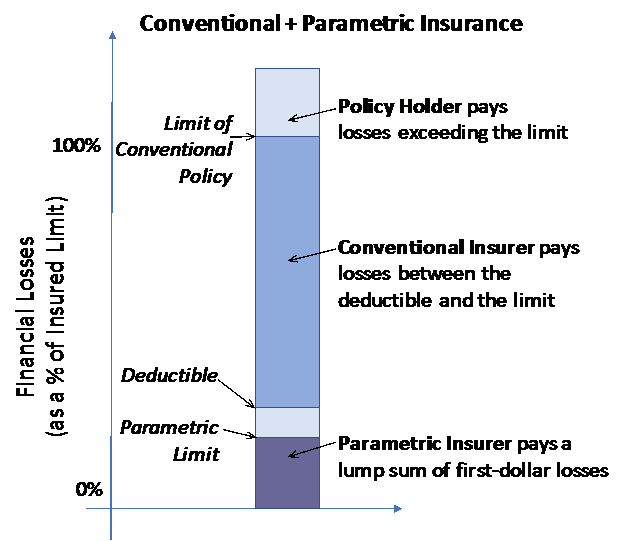

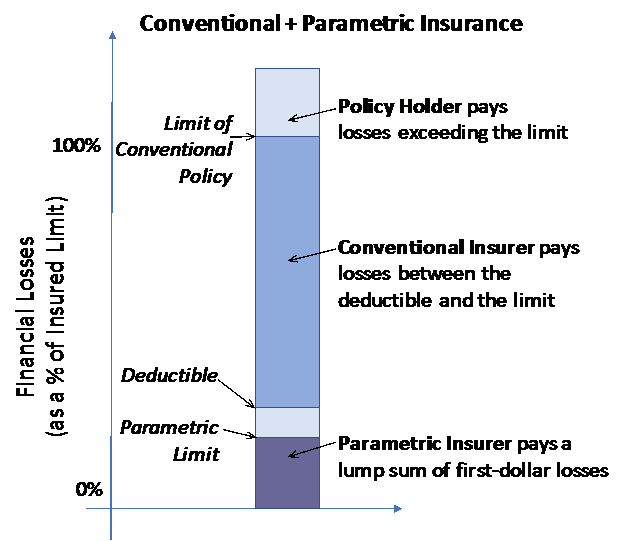

Conventional and Parametric Insurance

You can buy both a conventional policy and a parametric policy. In that case, here’s who’s responsible for what portion:

Now let’s put some numbers on this with a couple of examples for homeowners and renters:

- Examples for Homeowners:

In these examples you have a 2,000-square-foot house with a market value of $300,000.

The conventional insurance policy has an insured limit of $200,000, which assumes a replacement cost of $100 per square foot (2,000 sf * $100/sf = $200,000). The deductible is 10% of the insured limit ($20,000).

The parametric insurance policy has a lump-sum limit of $10,000.

1.1 Example Loss: $25,000

|

|

Conventional Insurer pays: |

Parametric Insurer pays: |

YOU PAY (out-of-pocket): |

| No disaster insurance |

$0 |

$0 |

$25,000 |

| Conventional Insurance alone |

$5,000 |

$0 |

$20,000 |

| Parametric Insurance alone |

$0 |

$10,000 |

$15,000 |

| Both Conventional + Parametric |

$5,000 |

$10,000 |

$10,000 |

In this example, if your losses are higher than the deductible of your conventional policy, your out-of-pocket costs are lowest if you have both policies.

1.2 Example Loss: $15,000

|

Conventional Insurer pays: |

Parametric Insurer pays: |

YOU PAY (out-of-pocket): |

|

| No disaster insurance |

$0 |

$0 |

$15,000 |

| Conventional Insurance alone |

$0 |

$0 |

$15,000 |

| Parametric Insurance alone |

$0 |

$10,000 |

$5,000 |

| Both Conventional + Parametric |

$0 |

$10,000 |

$5,000 |

This example shows that when the loss is less than the deductible of the conventional policy, only parametric insurance will offset your out-of-pocket costs.

1.3 Example Loss: $250,000

|

Conventional Insurer pays: |

Parametric Insurer pays: |

YOU PAY (out-of-pocket): |

|

| No disaster insurance |

$0 |

$0 |

$250,000 |

| Conventional Insurance alone |

$180,000 |

$0 |

$70,000 |

| Parametric Insurance alone |

$0 |

$10,000 |

$240,000 |

| Both Conventional + Parametric |

$180,000 |

$10,000 |

$60,000 |

This example shows that in a “total loss” situation, parametric insurance contributes only nominally to the total reimbursement. It also shows that you are responsible to pay the losses exceeding the limit of the conventional policy.

- Examples for Renters:

In these examples the conventional renters’ insurance policy has an insured limit of $25,000 for your personal property. It also has a deductible of $2,500, and a $1,500 for additional living expenses, with no deductible.The parametric insurance policy has a lump-sum limit of $10,000.

2.1 $12,000 Example Loss: $2k for personal property, $10k in moving expenses

|

Conventional Insurer pays: |

Parametric Insurer pays: |

YOU PAY (out-of-pocket): |

|

| No disaster insurance |

$0 |

$0 |

$12,000 |

| Conventional Insurance alone |

$1,500 |

$0 |

$10,500 |

| Parametric Insurance alone |

$0 |

$10,000 |

$2,000 |

| Both Conventional + Parametric |

$1,500 |

$10,000 |

$500 |

In this example, your losses are mainly due to the expense of disruption as opposed to damaged property, and you receive a higher payment from the parametric policy than the conventional renters’ policy.

2.2 $20,000 Example Loss: $10k for personal property, $10k in extra child care expenses

|

Conventional Insurer pays: |

Parametric Insurer pays: |

YOU PAY (out-of-pocket): |

|

| No disaster insurance |

$0 |

$0 |

$20,000 |

| Conventional Insurance alone |

$7,500 |

$0 |

$12,500 |

| Parametric Insurance alone |

$0 |

$10,000 |

$10,000 |

| Both Conventional + Parametric |

$7,500 |

$10,000 |

$2,500 |

In this example, your losses are higher than the deductible of your conventional policy, and your out-of-pocket costs are lowest if you have both policies.

Bottom line:

Parametric could make sense if one or more the of following applies to you:

- You care more about disruption to your life than about your stuff;

- You value speed and transparency of payments;

- You don’t want to tap into your savings to cover your deductible; or

- You believe your losses will be less than your deductible.