If your mobile or manufactured home was insured and damaged or destroyed in a catastrophic event, these tips are aimed at helping you negotiate a fair and full insurance claim settlement. Insurance policies covering mobile/manufactured homes generally offer four “buckets” of coverage,” just like a standard home insurance policy. But the limits of coverage and formulas for calculating benefits are different.

How much coverage do you have?

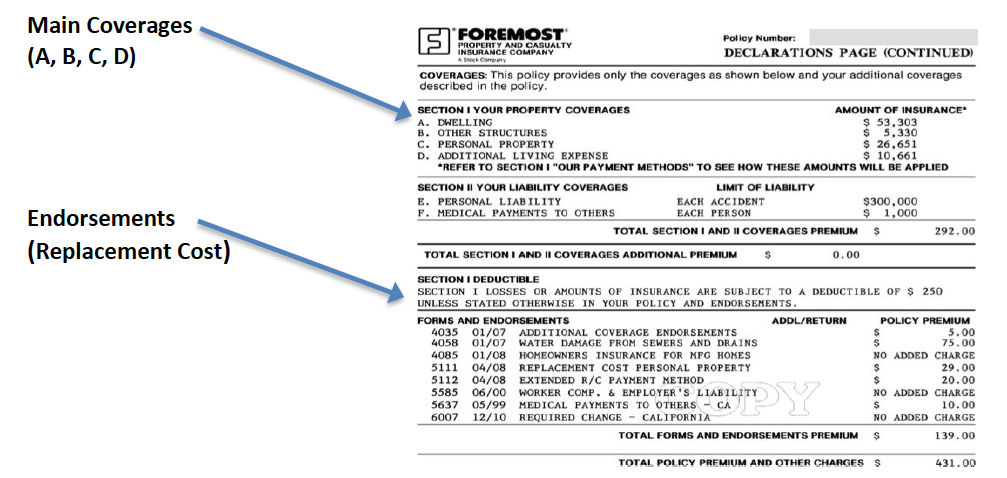

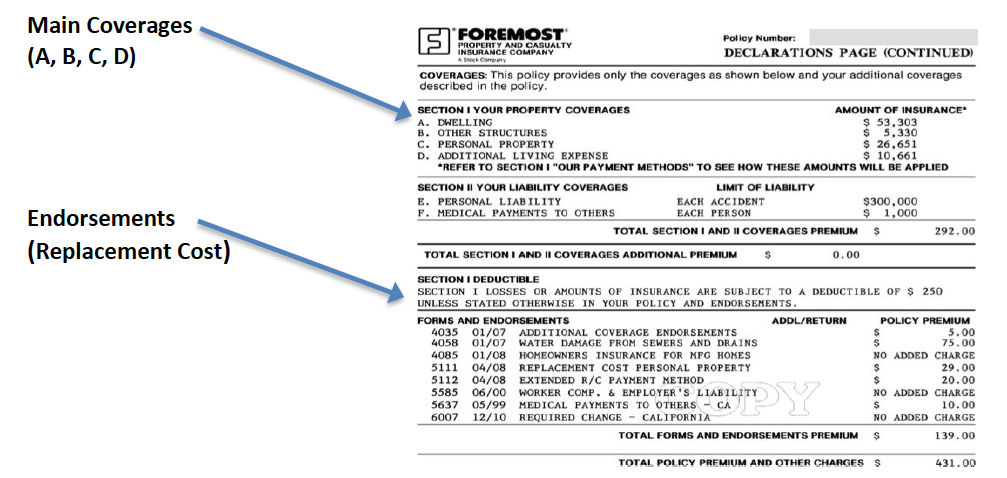

The first page of your policy, called the Declarations page, will list how much insurance you have for each bucket, plus any extras (called “endorsements” or “riders”) that may be included and available. Read it carefully, read your policy. Read them again. And again…Once you have a general sense of the maximum amount of insurance benefits you can collect, focus on figuring out the value/amount of your losses. If your home was destroyed, it is likely you will need and be entitled to every dime of available benefits. If your home was damaged, the value/amount of the damage may not hit your maximum available benefits.

What should you know about filing your claim?

If your home has been damaged or destroyed, file your insurance claim as soon as possible. If you are insured with Foremost, you can file your claim by calling: 1-800-527-3907 or by visiting www.foremost.com. If you are with American Modern, you can file your claim by calling: 1-800-375-2075 or by visiting www.amig.com. If you have a different insurance company, your State’s Department of Insurance.

Once you file your claim, request a complete copy of your policy. The complete policy includes the “dec” page in the example above, but also will include many more pages that explain how the policy pays your claim, what you have to do, and any exclusions or limitations that apply to your situation.

Once your claim is open and being adjusted, ask for an advance of Additional Living Expenses. This coverage is the amount in the example above listed as “Coverage D” (in the example above, the policyholder has $10,661 available). Additional Living Expense coverage pays for your hotel or rent until your home is repaired or replaced. The next step is to take stock of your losses. You will likely be required to submit an itemized inventory of your personal property. For help, including a pre-filled out inventory spreadsheet, please visit our Contents Claim Help page. You can request our hard copy “Disaster Recovery Handbook and Household Inventory Guide” by calling 415-393-9990 or emailing info@uphelp.org. For the structure part of your claim, you will want to start shopping around for a replacement home and provide the insurance company with estimates to replace your home with a comparable one.

Your insurance policy likely gives the insurance company the right to apply “depreciation” to your property when calculating what they owe you. Depreciation is a reduction in the value of an item to account for its age and condition immediately before it was damaged or destroyed. Think of depreciation as the “Craig’s List” value of a used item versus the amount it would cost to buy it new. It is important to understand three things about depreciation:

- There’s no one set formula, depreciation is subjective and negotiable.

- Some items don’t lose value due to age and should not be depreciated.

- Sometimes depreciation deductions are recoverable, sometimes not.

Once you submit a proof of loss or inventory for your personal property, your insurer should send you a check for the “Craig’s List” value of everything that is subject to depreciation. Mistakes by adjusters are common and rarely in your favor. Your policy may or may not define how depreciation should be calculated; this is the first place to check. Make sure your insurance company depreciates your personal property based on both age and condition. Push back if an adjuster is trying to depreciate everything by a set percentage across the board, or reduce the value of items that were in great condition. If you have replacement cost coverage, you will have the opportunity to replace the items and submit receipts to your insurance company for the difference between the price it costs to replace the item at today’s dollar value and what they paid you after depreciation. For your home, check to see if you have replacement cost coverage. If so, your insurance

company must pay you depreciated value upfront, and replacement cost once you purchase a new home. For more information on depreciation, see our page on Depreciation Basics.

Check to see if your policy covers “debris removal.” You may need de-titling and salvage certificates before removing what is left of your home.

Does it matter whether my home is a mobile or a manufactured home?

The label “mobile home” refers to pre-1976 (when the National Mobile Home Construction and Safety Standards Act went into effect). They typically had an exposed chassis and trailer hitch and were used by workers who traveled around the country for work. In the present day, we use the terms “mobile home” and “manufactured home” interchangeably, but manufactured homes are not necessarily the same as “modular homes.” Modular homes meet local building codes and, unlike a manufactured home, they are always anchored to a permanent foundation like a constructed house.

Modern manufactured homes come in three varieties: singlewide, doublewide, and triplewide. They can be placed on piers or on a permanent cement foundation or basement. It is important to determine how yours was constructed when presenting your claim to your insurance company.

What’s the bottom line?

We recommend that you think of your insurance claim as a business negotiation and take a pro-active approach to collecting your full benefits. The process is unfamiliar to you, but you paid for coverage and claim service and you have the right to fair treatment. Keep a journal, make a paper trail. Communicate in writing by mail or email as much as possible. Be polite, but assertive. Give your insurance company a chance to do the right thing, but don’t be a pushover. It is your obligation to cooperate with your insurer in providing information on what you lost and what you need. Although your insurance policy is a legal contract, don’t be afraid to ask for exceptions or extensions and if your interpretation of your policy is reasonable, push for it. Finally, remember that recovery is a marathon, not a sprint, and United Policyholders is here to help.

The information presented in this publication is for general informational purposes, and should not be taken as legal advice. If you have a specific legal issue or problem, United Policyholders (“UP”) recommends that you consult with an attorney. Guidance on hiring professional help can be found in the “Find Help” section of our website. UP does not sell insurance or certify, endorse or warrant any of the insurance products, vendors, or professionals identified on our website. UP respects and protects the privacy of all individuals who communicate with us. We do not sell or share our membership or mailing lists.