Why Buy Auto Insurance?

Security, responsibility, and peace of mind. Every state (except for New Hampshire) requires you to have auto insurance in order to legally drive a car. In addition to complying with the laws in your state, you should consider whether you are buying enough insurance to:

1) Cover costs related to your or your passengers’ physical injuries in an accident.

2) Cover costs related to other people’s physical injuries or property damage in an accident you are involved in.

3) Cover the repair or replacement cost of your vehicle due to an accident.

Coverage Types

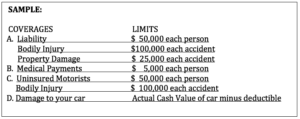

The typical auto policy provides monetary benefits that become available to you in the event of an accident. These benefits and any selected optional coverages are divided into categories, each with a “limit” (maximum payout cap). Your policy’s “declarations page” lists the categories of coverage and limits you have purchased.

For example:

State laws require you to maintain specific types and minimum amounts of auto coverages, and beyond those, you can choose to add more.

Liability Coverage

This coverage protects you if you are at fault for bodily injury or property damage caused by an auto accident. Auto liability insurance is made up of two components, bodily injury liability coverage and property damage liability coverage. Bodily injury liability covers payment for medical care, loss of income and/or funeral expenses for other people involved in an accident. Property damage liability covers payment for the repair or replacement of another driver’s car and/or other people’s property that is damaged in an accident.

Medical Expense Coverage (Medical Payments and PIP)

Medical expense coverage pays for medical costs that you and your passengers incur in an accident, and in some cases, injured pedestrians, regardless of fault. In some cases, related costs such as loss of income, childcare expenses and funeral costs are also covered. In some states, motorists are required to have PIP coverage while medical payments coverage is typically optional.

Uninsured and Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage pays your medical costs, lost wages and other injury-related expenses when the driver at fault for an accident is uninsured or underinsured (does not have high enough coverage limits), or if you are injured by a stolen vehicle or involved in a hit-and-run accident.

Damage to your car – Comprehensive and Collision Coverage

Collision coverage pays for damage to your own vehicle in the event you hit another vehicle or object (not including an animal). Comprehensive coverage pays for damage to your own vehicle caused by fire, flood, theft, vandalism, glass breakage, hail, an animal, or wind damage.

Other Coverages

Auto policies may contain other optional coverages, such as loss of use coverage, sometimes called rental reimbursement, which covers the cost of renting a vehicle while your car is being repaired for a covered loss, and roadside assistance coverage, which covers costs related to emergency roadside assistance and towing.

Coverage Limits

Each category of coverage is subject to a limit, the maximum amount an insurer will pay for losses in that category. Limits of coverage are usually expressed as three numbers (for example, $50,000/$100,000/$25,000 or sometimes expressed as 50/100/25). The first number indicates the most the insurer will pay for bodily injury to any one person in an accident. The second number indicates the most the insurance will pay for all bodily injury to all persons combined in any one accident. The third and final number indicates the most the insurer will pay for all property damage in any one accident.

Things To Consider:

- Buy adequate liability and uninsured motorist coverage

A common mistake people make when buying car insurance is buying too little liability and/or uninsured motorist coverage limits. If you cause an accident with injuries and/or property damage that are higher than your coverage limits, you can be responsible for paying the difference out of your own pocket. With inadequate liability coverage, a single auto accident can have a dramatic effect on you financially.

Another type of liability coverage you should consider is uninsured/underinsured motorist (UM/UIM) coverage. UM/UIM coverage protects you and your passengers if you’re hit by someone who carries little or no insurance. In some states, 40% of drivers fall into this category so it is important to carry adequate UM/UIM coverage.

- Decide whether you need Collision and Comprehensive Coverage

If you own a high value car or one that is financed by a loan or lease, then collision and comprehensive coverage may make sense (or may be required by a lender). If you drive an older car, you may want to forego these two options to avoid paying out more in premiums over time than the car is worth.

As a rule of thumb, divide your car’s replacement value by 5 and compare the result to the annual cost of collision and comprehensive coverage. If the cost of coverage is higher, you might want to drop those coverage options

The condition and value of your car should have no bearing on the amount of your liability Insurance. Even if you are driving an old “clunker”, you should still have adequate liability and uninsured motorist coverage.

- Compare, compare, compare

Auto insurance rates are based on a number of factors including the city and state you live in, type of vehicle, driving record, age, your credit score, etc. Each insurer uses its own method for deciding what kind of risk you are and pricing your policy. Since these, and other factors, can cause auto insurance rates to vary widely, obtaining quotes from multiple different insurance companies may save you money.

If there are multiple drivers and cars of different ages in your household, you may be better off with one policy or separate policies. Purchasing separate policies for “high-risk” drivers in your household may or may not turn out to be a less expensive option.

- Choose the right deductible

The higher the deductible you choose, the lower your premium will be, and consumer advocates generally agree that opting for higher insurance deductibles makes good economic sense. Not only do you save money on your premium, but you’ll also pay less for your insurance in the long run if you avoid filing small claims and save your insurance for serious damage and injuries. The more claims you file, the more you’ll pay for your insurance because you’ll be placed in a higher risk (more expensive) rating category.

Get auto insurance premium quotes based on several different deductibles and decide which is right for you. If you can afford to pay repairs or damage below $1,000 then setting your deductible at $1,000 (instead of $500 or $250) will save you money on your annual premiums. If you assume that a claim will occur once every five years or so, multiply the premium savings by 5, if it equals the difference in the deductible amount and you can afford to pay it then opt for the higher deductible.

- Should you buy Medical Payments or PIP Coverage?

Med Pay coverage is for medical costs for you and your passengers. Ask about the cost of including this coverage. If you have a good health insurance plan in place, you may not need additional medical coverage, other than to cover co-pays, but Med Pay coverage can be inexpensive and well worth paying for.

Medical expense coverage protects other passengers in your vehicle by providing “no-fault” coverage for basic injuries without having to file a lawsuit. PIP Coverage or “Personal Injury Protection” is a similar coverage created by state law and is available or required in certain states.

- Ask for discounts

- Ask about all of the discounts you may be eligible for. They can include:

- Customer loyalty (multiple policy or multiple auto)

- Good driver

- Good credit score

- Good student

- Age

- Safe driving coursesSafety equipment (anti-lock brakes, etc.)

- Miles driven (less is better)

- Electric vehicle or hybrid

- Affiliations (military, Federal employee, credit unions, alumni associations, professional memberships)

7. Buying through an insurance agent vs. buying online

- A professional insurance agent or broker can help select coverage tailored to your needs and answer any questions you may have.

- If you shop online, be sure you are buying appropriate liability and UM/UIM limits that will protect you and your family from catastrophic financial losses. Online quotes often start with the minimum legal liability limits that may not be the right limits for you. Shop for right coverage, not just the right price.

- You may save money by insuring your home/rental and auto through the same insurance company. Get quotes for combining or splitting up your policies.

8. Pay-by-the-mile insurance

Certain insurance companies are now offering what is known as “pay-by-the-mile” or “pay as you drive” insurance. Unlike traditional car insurance, which requires you to declare the amount of mileage you intend to drive each year (generally in broad increments) and which is based on traditional rating factors, this type of insurance charges a base rate and then a per-mile fee based on GPS data collected as you drive. In many cases, drivers end up with a lower yearly premium, especially those who live in the city and drive very little.

Auto Insurance Claim Tips

– Always take photos and get other drivers’ license plates and insurance info, even after a minor accident. It’s not uncommon for people to claim injuries after the fact.

– If you’re in a non-injury accident, consider paying for minor physical damage to your car out of pocket to avoid filing a claim that will put you in a higher risk, higher premium category.

Shopping Notes:

When shopping for auto insurance, it’s best to get more than one quote and take notes while you gather information. Jot down with whom you speak and when.

United Policyholders is a 501(c) (3) non-profit organization that has served as an information resource and voice for insurance consumers since 1991. The organization is funded by grants and donations, but accepts no financial support from insurance companies. Our work is divided into 3 program areas: Roadmap to Recovery™, Roadmap to Preparedness, and Advocacy and Action. We offer free tips, information and resources in print and online at www.uphelp.org. The information presented in this publication is for general informational purposes, and should not be taken as legal advice. All rights reserved. (c) 2015.