If you are injured in Florida and are making a claim against a person or business related to your injury, you’ll want to know the details of their insurance as soon as possible. This is often a challenge, but in Florida there is a law that requires the motor vehicle and other liability insurer for anyone else involved in the event that caused your injury to disclose insurance information within thirty days of your written request. (Section 627.4137, Florida Statutes) The statute also requires the insured, or his or her insurance agent, to disclose the name and coverage of each known insurer to you (the claimant).

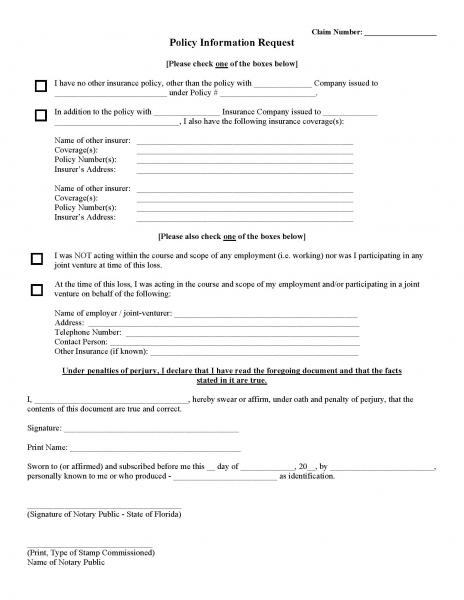

Most liability insurers have developed forms to make the disclosures of other coverage, but some word the form to disclose what the carrier knows – which is not what the statute calls for. Below is an example of a disclosure form one carrier has its insureds complete, which lists other coverages, and discloses if the insured was working for his or her employer at the time (which could trigger additional coverage).

You can use this form when requesting insurance information related to the event that caused your injury.

Click on the form below to englarge the form and for a printer-friendly version.