If your apartment or home was damaged or destroyed in a catastrophic event and you have Renters Insurance, these tips are aimed at helping you negotiate a fair and full insurance claim settlement. Renters insurance policies list your name and the address of the home you lived in and typically offer Personal Property Coverage (Coverage C), to cover the cost to clean or replace your belongings, and Loss of Use Coverage (Coverage D) for additional living expenses you incur until you find a replacement home or apartment.

How much coverage do you have?

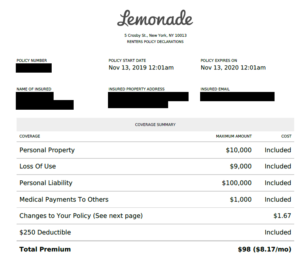

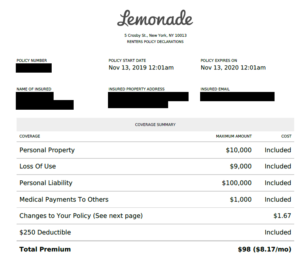

Declarations page sample

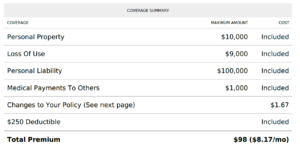

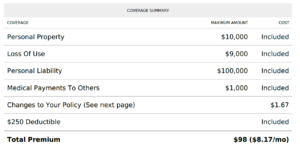

The first page of your policy, called the Declarations (“dec”) page, will list how much insurance you have for area of coverage, plus any extras (called “endorsements” or “riders”) included in your policy. Read it carefully. Once you have a general sense of the maximum amount of insurance benefits you can collect, focus on figuring out the value/amount of your losses.

Your policy covers the cost to clean or replace your belongings (what you would take with you if you moved), plus coverage for additional expenses until you can relocate to a new rental. If your rental home was destroyed, it is likely you will need every dime of available benefits. If your home was damaged, the value/amount of the damage may or may not hit your maximum available benefits.

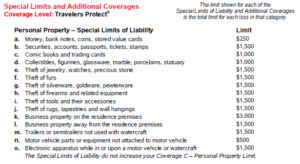

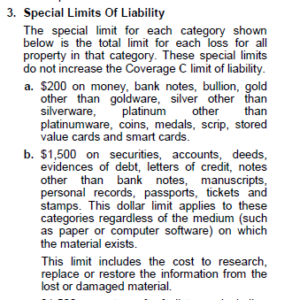

Coverage C (Personal Property, or Contents) includes the benefits you are entitled to clean or replace your belongings or “stuff.” Coverage C may also include special sub-limits that state the total amount your insurer will pay for each category. Sub limits are typically listed in the fine print of your policy. Your policy may also include “riders” that provide additional coverages. Some common contents limits include:

- Money – $150 – $500

- Securities – $1,000

- Business Property – $500- $2,500

- Trailers – $1,000

- Computers/Electronic Equipment – $5,000

Coverage D (Loss of Use, or Additional Living Expenses) includes the benefits you are entitled to due to losing use of your rental, so that your household can maintain its normal standard of living. Coverage and limits vary by company, so check your declarations page AND the fine print for your Loss of Use limits. You may find they are a dollar amount limit, a time limit, a dollar and time limit, or “Actual Loss Sustained.”

Examples of basic coverages

|

|

What should you know about filing your claim?

If your rental home has been damaged or destroyed, file your insurance claim as soon as possible. If your rental wasn’t damaged, ALE coverage may apply if you were displaced due to a mandatory evacuation (often capped at two weeks). If the food in your refrigerator spoiled due to the disaster causing an interruption to the power, check your policy to see what the terms are for power interruption. The California Department of Insurance can help you find how to get in contact with your insurer by calling 1-800-927-HELP or by visiting www.insurance.ca.gov.

Once you file your claim, request a complete copy of your policy. The policy includes the “declaration” page in the example above, but also will include the insurance policy/contract and all endorsements that explain how the policy pays your claim, what you have to do, and any exclusions or limitations that apply to your situation, including special sub-limits. If you need help requesting your policy, use UP’s sample letter at www.uphelp.org/samples.

Documentation is key, so present your requests clearly and in writing. Explain what you need, when you need it, and why you are entitled to it. Keep a claim journal and record who you talked to, when you called (date/time), what was said. Keep all of your paperwork organized and together. Keep notes on communications with your landlord as well.

The California Fair Claims Settlement Practices Act outlines the claim handling standards your insurer should be following. It includes 15 days to respond to communications (by email, letter, or phone call), 40 days to pay or deny your claim, and if they are unable to make a decision, they must send a letter stating what they need from you to make a decision, how long they need to make the decision.

Loss of Use/Additional Living Expense Claim Tips

Once your claim is open, ask for an advance of your Coverage D, Loss or Use or Additional Living Expenses (ALE). ALE pays the increased cost over and above what you normally spend to maintain your standard of living.

For example, if you usually pay $1,500 in rent per month, but now are paying $2,000 for your temporary rental while waiting for your previous home to be repaired, the additional $500 is an increased cost. If your monthly food costs were $500 but now you have to eat out and your costs are now $1,000, then the additional $500 is an increased cost. However, if your utility bill was $150/month before, but is now included in your rent, then your insurer might deduct that since you are saving the $150/month.

You are entitled to live at the same standard of living as before the loss – same number of bedrooms, bathrooms, amenities, air conditioning, type of neighborhood, etc. Ask your insurer for their list of what they cover under ALE. Typically it covers extra mileage due to displacement from normal location, new account “set up” fees at temporary housing, photocopies and mailing expenses related to the claim, moving costs, pet boarding costs, among others.

This amount of coverage you have is listed as “Coverage D.” If you are staying with family or friends, ask for an advance. You can negotiate with your insurance company for an amount based upon the fair rental value of the home you lost. You can continue claiming ALE while you are in a temporary rental. Most policies specify “shortest time required to repair or replacement the damaged premises, or for your households to settle elsewhere”. This coverage stops when you return to your previous rental or settle elsewhere permanently.

While California state laws require insurers to offer ALE for a period of at least 36 months, most renters’ policies have minimal limits and the insurance company is not obligated to pay above the limit stated on your “dec” page.

Contents/Personal Property Claim Tips

The next step is to take stock of your personal property losses. These are your belongings, what you would take if you moved. This can be done using our Home Inventory and Contents Claim Tip publication at www.uphelp.org/pubs/home-inventory-and-contents-claim-tips. Ask for an advance of your “Coverage C” to get started. If you have suffered a total loss and your limits are low, ask (in writing) for a waiver of the inventory requirement and a “cash out”/settlement of your contents/personal property limits. If your insurance company insists on an itemized inventory of your personal property, you can download UP’s pre-filled out inventory spreadsheet at: www.uphelp.org/samples. You can request our hard copy “Disaster Recovery Handbook and Household Inventory Guide” by emailing info@uphelp.org.

|

|

Your policy may have limits or riders on certain categories of possessions. Common contents limits include: money ($150-$500), securities ($1,000), business property ($500 – $2,500), computers/electronics equipment ($5,000).

Some items are not usually covered: cars, animals, birds, and fish; property of roommates; motor and recreational vehicles.

Your insurance policy likely gives the insurance company the right to apply “depreciation” to your property when calculating what they owe you. Depreciation is the deduction in value of your personal property due to wear and tear to account for its age and condition immediately before it was damaged or destroyed. It is important to understand three things about depreciation:

1) There’s no one set formula, depreciation is subjective and negotiable.

2) Some items don’t lose value due to age and should not be depreciated.

3) Sometimes depreciation deductions are recoverable, sometimes not.

Once you submit a proof of loss or inventory for your personal property, your insurer should send you a check for the “Craig’s List” value everything that is subject to depreciation. Mistakes by adjusters are common and rarely in your favor. California law requires your insurance company to depreciate your personal property based on both age and condition, so push back if an adjuster is trying to depreciate everything by a set percentage across the board, or reduce the value of items that were in great condition. Be sure to save all of your receipts

Replacement Cost or Actual Value Cash Value?

After a loss, your insurer will write you a check for the contents destroyed using actual cash value. Actual cash value is the value of your property right before the loss. In California, most renters policies provide replacement cost coverage, but not all. Be sure to look for a replacement cost endorsement on your declarations page and policy. Replacement cost equals the amount it will cost for you to replace your belongings brand new after the loss. If you have replacement cost coverage, you will have the opportunity to replace the items and submit receipts to your insurance company for the difference between the price it costs to replace the item at today’s dollar and the initial actual cash value amount (what they paid you after depreciation was applied). If you have suffered a total loss and your limits are low, you may be able to bypass this process by asking (in writing) for a waiver of the inventory requirement and a “cash out”/settlement of your contents/personal property limits.

What’s the bottom line?

We recommend that you think of your insurance claim as a business negotiation and take a pro-active approach to collecting your full benefits. The process is unfamiliar to you, but you paid for coverage and claim service and you have the right to fair treatment. Keep a journal, make a paper trail. Communicate in writing by mail or email as much as possible. Be polite, but assertive. Give your insurance company a chance to do the right thing, but don’t be a pushover. It is your obligation to cooperate with your insurer in providing information on what you lost and what you need. Although your insurance policy is a legal contract, don’t be afraid to ask for exceptions or extensions and if your interpretation of your policy is reasonable, push for it. Finally, remember that recovery is a marathon, not a sprint, and United Policyholders is here to help. www.uphelp.org

The information presented in this publication is for general informational purposes, and should not be taken as legal advice. If you have a specific legal issue or problem, United Policyholders (“UP”) recommends that you consult with an attorney. Guidance on hiring professional help can be found in the “Find Help” section of www.uphelp.org. UP does not sell insurance or certify, endorse, or warrant any of the insurance products, vendors, or professionals identified at our website. UP respects and protects the privacy of all individuals who communicate with us. We do not sell or share our membership or mailing lists.