General Contractors charge for Overhead and Profit (“O & P“) as line items on repair or rebuild estimates. Insurers sometimes balk at paying O & P, but they are legitimate costs of doing business and policyholders are entitled to collect insurance benefits to cover them in most scenarios.

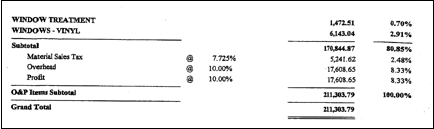

O & P covers a General Contractor’s time and expenses and is calculated as a percentage of the total cost of a job. The rule of thumb is that any time a General Contractor (“GC”) is involved in a job with three or more “trades” (subcontractors such as plumbers or electricians), he/she is entitled to be paid for supervision and coordination. Overhead and Profit are two different types of costs, but they’re almost always paired under the label “O & P” and stated as two separate numbers; for example “10 and 10”. Overhead costs are operating expenses for necessary equipment and facilities. Profit is what allows the GC to earn their living. O & P are stated as a percentage of a total job. Where O & P are set at “10 and 10”, they will be charged as 20% on top of the total job estimate.

Common questions that can arise during the adjustment of an insurance claim:

- Whether the required construction work will need the type of supervision and coordination that warrants payment of overhead and profit[1];

- How much O & P the job will require – 5/10, 10/10, 10/15, or even 20/20 if it’s a particularly challenging project or situation;

- Whether initial payments of actual cash value amounts should include O & P[2]; and

- Whether a property owner who acts as his/her own GC is entitled to be paid O and P.

The following aims to help policyholders/property owners answer those common questions:

What is a General Contractor and when do you need one?

A general contractor oversees the entire construction project, hires the required trades (carpentry, masonry, plumbing, electrical, etc.) and sequences, coordinates and supervises their work. The longstanding rule is that whenever more than three trades are involved, a general contractor is needed. The general contractor is also responsible for researching zoning requirements and obtaining necessary permits.

Some examples of overhead expenses are:

- General and administrative expenses;

- Office rent and utilities;

- Office supplies;

- Salaries and benefits for office personnel;

- Depreciation on office equipment;

- Licenses; and

- Advertising.

Every general contractor is also entitled to a profit, which is defined as the difference between the cost of goods and the price for which they are sold.

If you do not hire a general contractor and instead coordinate trade work yourself, you can make an argument that you are entitled to O & P. Insurers often resist paying O & P to a policyholder/property owner, especially if he or she is not a construction professional. But many property owners who have documented that they are putting in the time and resources a general contractor would put in and who have used UP’s resources to negotiate well have been paid O & P as part of their claim settlement.

Industry Custom and Practice

Textbooks commonly used in the insurance industry include contractor overhead and profit as a component of repair or replacement cost.[3]

Specific elements comprising repair or RC include:

- Materials;

- Labor and employers’ burden;

- Tools and equipment;

- Overhead and profit; and

- Miscellaneous direct costs such as permits and taxes.

Why Should O&P Always Be Included?

Many insurers include both general and specialty contractor/subcontractor O & P when estimating the replacement cost that determines the limit of liability upon which a policyholder’s premiums are based. A strong argument can be made for including the costs in every loss, not just when specialty contractors/subcontractors are needed.

Other UP Claim Help Library Publications:

- The Scoop on “Scope” (of Loss)

- Tips for Reviewing Adjusters’ and Contractors’ Estimates

- Rebuilding 101: A Guide to the Reconstruction Process

- Questions to Ask a Contractor

- Xactimate Demystified

Additional References:

Pennsylvania Court rules insurance companies are required to include general contractor overhead and profit in actual cash value payments for losses where repairs would be reasonably likely to require a general contractor, Kevin Pollack, Esq. of the Merlin Law Group, Property Insurance Coverage Law Blog, May 1, 2017: http://www.propertyinsurancecoveragelaw.com/2017/05/articles/court-opinion/are-insurers-required-to-pay-overhead-and-profit-for-payments-made-on-actual-cash-value-basis/

Adjusting Today: “Overhead & Profit: Its Place in a Property Insurance Claim”, Edward Eshoo Jr. Esq., of Childress Duffy in Chicago, Illinois (http://www.adjustersinternational.com/AdjustingToday/ATfullinfo.cfm?start=1&page_no=1&pdfID=43);

Merlin Law Group Property Insurance Coverage Law blog, March 2013 entry by Corey Harris, Esq. Tampa, Florida http://www.propertyinsurancecoveragelaw.com/2014/03/articles/insurance/payment-of-overhead-and-profit/index.html

Property Loss Adjusting, JD Donna J. Popow (2003), a textbook published by the Insurance Institute of America for use in its insurance designation and certification programs.

[1]Widely-accepted construction estimating publications like Marshall & Swift/Boeckh, RS Means, and Sweets that are used in the insurance industry in estimating the replacement cost of commercial buildings and residential dwellings, define replacement cost to include labor, materials, and contractor’s O & P.

[2]The Property Loss Research Bureau (PLRB), a recognized resource used by insurers in the interpretation of property insurance policy provisions, has taken the position that “contractor’s overhead and profit are included in ACV, because they are part of replacement cost.” – “Any estimate of actual cash value should include O & P.”

[3] Replacement Cost (“RC”) versus Actual Cash Value (“ACV”) are two ways of measuring the value of an item or a construction project. An object (such as a couch) has both a replacement and an actual cash value. A repair or rebuilding project has both a replacement and actual cash value. Most insurance policies contain specific definitions of these two terms. In this publication we are only talking about repair and rebuilding projects. O & P has nothing to do with replacing an object (a couch, lamp, etc.). Most states have laws about RC and ACV. UP discusses these terms in many of our Claim Help Library publications. While most insurers sell RC value coverage, their policy contracts generally say they are not obligated to pay more than ACV until damaged or destroyed property is actually repaired or replaced.