Bach Talk

As we work to stay the course in two communities ravaged by wildfires and strive to raise the necessary funds to cover the costs, we are connecting with flood victims and our partners in the Lone Star State. We are beefing up our Flood Claim Guidance Library and are deep in the mix on efforts to create better and more affordable flood insurance options for consumers.

Fire victims are lucky in one respect: Insurance kicks in, no question. Flood victims…not so much. As more and more people learn about UP and turn to us for insurance information and help, we hope you will stay the course with us and support us as we soldier on to EMPOWER the insured!

Taking temperatures, checking in

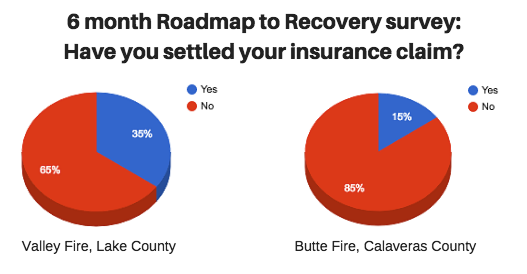

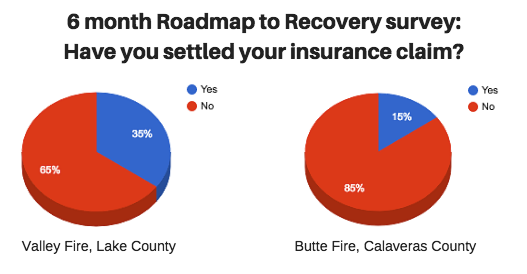

The results are in! Hundreds of households hit by September 2015 wildfires in two parts of California recently completed a UP survey and gave us useful data on their recovery progress and the problems they’re encountering. Surveys are part of our Roadmap to Recovery services. We use the results to tailor our workshops to meet people’s needs, gauge the pace of recovery, and advocate for solutions.

The recent 6-month survey data shows that United Policyholders is still needed:

More than half of those who completed our survey reported that they are underinsured. Insurance companies and agents are continuing to lull people into a false sense of security that their home policy limits are high enough to cover a total loss when in fact they are not. The good news is that our hard work and publicity on this problem are having an impact. Fewer households reported being underinsured than in past surveys. But the majority of wildfire-impacted households have not settled their insurance claims and still need our help.

We also learned that some insurers are not complying with their agreement to give a cash advance of policy benefits to cover rent for displaced victims. UP is working hard to educate people about their rights under the agreement and California laws in general.

Here are key survey results from Lake County residents:

- 65% of survey respondents reported they have not yet settled their claim

- 53% of survey respondents do not have enough insurance to cover the cost of repairing, replacing or rebuilding their house by an average of $103,000

- 64% of survey respondents reported they do not have enough insurance to replace their belongings by an average of $87,600

- 53% of survey respondents reported that their insurance company did not explain depreciation and what they need to do to collect the full replacement value on depreciated items.

- 31% of survey respondents reported delays in insurance company representatives answering questions, phone calls or emails.

Read the full Valley Fire – 6 month survey data here.

Here are key survey results from Calaveras County residents:

- 85% of survey respondents reported they have not yet settled their claim

- 65% of survey respondents reported that they do not have enough insurance to cover the cost of repairing, replacing or rebuilding their house.

- 69% of survey respondents reported that they do not have enough insurance to replace their belongings.

- 56% of survey respondents reported that their insurance company did not give them an advance of 4 months of their ALE coverage.

Read the Butte Fire – 6 month survey data here.

The Roadmap to Recovery program™ on the ground

Thanks to a grant from the Home Depot foundation, individual and business donors, local partners and volunteers, UP has distributed over 400 Disaster Recovery Handbooks, 220 Organizer Kits, and hosted 10 Roadmap to Recovery™ workshops in the regions devastated by the Butte and Valley Wildfires. A full list of the workshops is available at the end of this newsletter. We continue to answer questions via emails, phone calls and our Ask an Expert forum, and are updating our website library for the impacted communities on a weekly basis.

(Certified Public Accountant and UP Volunteer Diana Sosa, offering post-disaster income tax guidance at a UP Roadmap to Recovery workshop in Mountain Ranch, CA)

UP was a featured presenter at the Valley Fire Rebuild Expo in February that was attended by 1,000 local residents over two days. We highlighted our help resources and walked people through strategies for overcoming common obstacles. We staffed a table, answered questions and distributed information.

We need and are actively seeking funding to provide at least two more educational and support events in each region. We want to stay the course through the emotionally challenging one-year anniversary in both communities by hosting our “Decisions and Deadlines-Healing and Dealing” workshops this summer. Can you help us provide these valuable services?

(Emily from United Policyholders and Faye from Home Depot both participated in the Valley Fire Rebuild Expo reaching 1,000 Valley Fire Survivors)

Butte & Valley Fire Roadmap to Recovery ™ Workshops

Thanks to our supporters, partners and volunteers, we have provided the following workshops to Valley and Butte Fire survivors.

10/8/15: Valley Fire “Insurance 101/Recovery Orientation”

This workshop provided basic information on insurance policy rules, consumer rights and how the claim process should go. We educated the audience on three main parts of their policies (Dwelling, Contents, Loss of Use coverage) and provide guidance on removing debris and decisions that are typically made in the first phase of disaster recovery.

10/14/15: Butte Fire “Insurance 101/Recovery Orientation”

This workshop provided basic information on insurance policy rules, consumer rights and how the claim process should go. We educated the audience on three main parts of their policies (Dwelling, Contents, Loss of Use coverage) and provided guidance on removing debris and decisions that are typically made in the first phase of disaster recovery.

11/10/15: Valley Fire: “Getting a fair settlement on your insurance claim”

This workshop included guidance on how to get a fair settlement on a home insurance claim. How to document and value the damage to your home and property, figuring out what your policy entitles you to recover, and reading and understanding repair and rebuilding estimates.

11/20/15: Butte Fire: “Tips on settling the contents portion of the claim”

This workshop included guidance on how to get a fair settlement on the contents portion of your insurance claim as well as strategies for completing your home inventory and understanding depreciation.

12/3/15: Valley Fire “Underinsurance”

This workshop discussed underinsurance, strategies for overcoming this obstacle and sources of financial help. We went over effective claims communication techniques and insurance legal rights in California.

1/12/16 & 1/13/16 Valley Fire “Post-Disaster Income Tax Workshop”

This workshop included guidance on income tax filing strategies that can help and hurt people after a casualty loss. We went over special rules for federally declared disasters and documenting insured and uninsured losses.

1/13/16: Butte Fire “Tips for settling the dwelling portion of your insurance claim.”

This workshop included guidance on estimating a partial or total dwelling loss and negotiating a reasonably prompt, full and fair settlement of a home insurance claim. We discussed how to document and value physical damage and/or destruction of structures/real property, reviewing and understanding repair and rebuilding estimates, scopes of loss and complying with local building requirements.

1/21/16: Valley Fire “Contents Claims”

This workshop included guidance on how to get a fair settlement on the contents portion of your insurance claim as well as strategies for completing your home inventory and understanding depreciation.

2/25/16: Valley Fire “Resolving Claim Disputes”

This workshop included guidance on resolving claim disputes over fair market value, depreciation, causation, and policy interpretation. We discussed the main factors to consider when deciding which resolution path to take, followed by a brief overview of each process: negotiation, alternative dispute resolution, and litigation and arbitration.

2/26/16: Butte Fire “Post-Disaster Income Tax Workshop”

This workshop discussed the complexity of casualty loss rules outlined by the Internal Revenue Code. We reviewed questions and tips that should be considered before making major decisions about rebuilding the damaged home, replacing property and filing tax returns. We also covered underinsurance, strategies for overcoming this obstacle and sources of financial help.

For more information on how our Roadmap to Recovery™ program is assisting Valley and Butte Fire survivors, click here.