A message from Co-Founder and Executive Director, Amy Bach

State regulators appreciate hearing consumers’ perspectives via UP

“We’ve got your back when insurance matters” is our clever way of explaining our organization’s value and mission. Like it or not, insurance really does matter to your financial and physical health and the quality of your life. But it sure is hard to shop for and use. Being your trustworthy information source and insurance fairness advocate is the goal of our staff and volunteers every day all day.

As insurers reduce coverage in anticipation of climate change, use data mining to select (and drop) customers and automate claim handling to bolster profits, Americans need UP more than ever. The good news is our support base is growing along with the demand for our services.

Please support UP, like our Facebook page, remember our URL and share it with friends, family and co-workers: UPHELP.ORG

- Roadmap to Recovery

- Advocacy and Action

- Roadmap to Preparedness

- UP in the News

- Thanks to Departing Board Members

- Donors and Funders

Post-disaster tools and guidance focused on restoring financial health

Local Motion

Speakers at our Roadmap to Recovery workshops bring expertise that ranges from permitting to taxes to “move or rebuild” decision-making. Some are previous disaster survivors; others are government agency or private sector professionals. Thanks to grant funding, we are recording our workshops so they can be viewed online 24/7.

Increased foundation support is making it possible for UP to hire local coordinators who live in or near disaster areas. These part time staffers help us reach survivors and coordinate with case managers, city and county building departments, housing navigators and other nonprofitts doing long term recovery work. For the Camp Fire (Paradise, CA, 18,000 structures destroyed), we hired local resident Maitreya Badami to help us stay connected with impacted residents and run our workshops, webinars, and clinics.

For the Woolsey Fire (Los Angeles and Ventura counties, 1,600 structures destroyed), we hired SoCal resident Valerie Brown as our local coordinator.

“Thank you because you made us more prepared to fight this battle! I don’t know if I would have been able to navigate this process without all the knowledge I gained from your workshops and website.” – Aimee S., Camp Fire Survivor

Attorney Volunteers Deliver Results

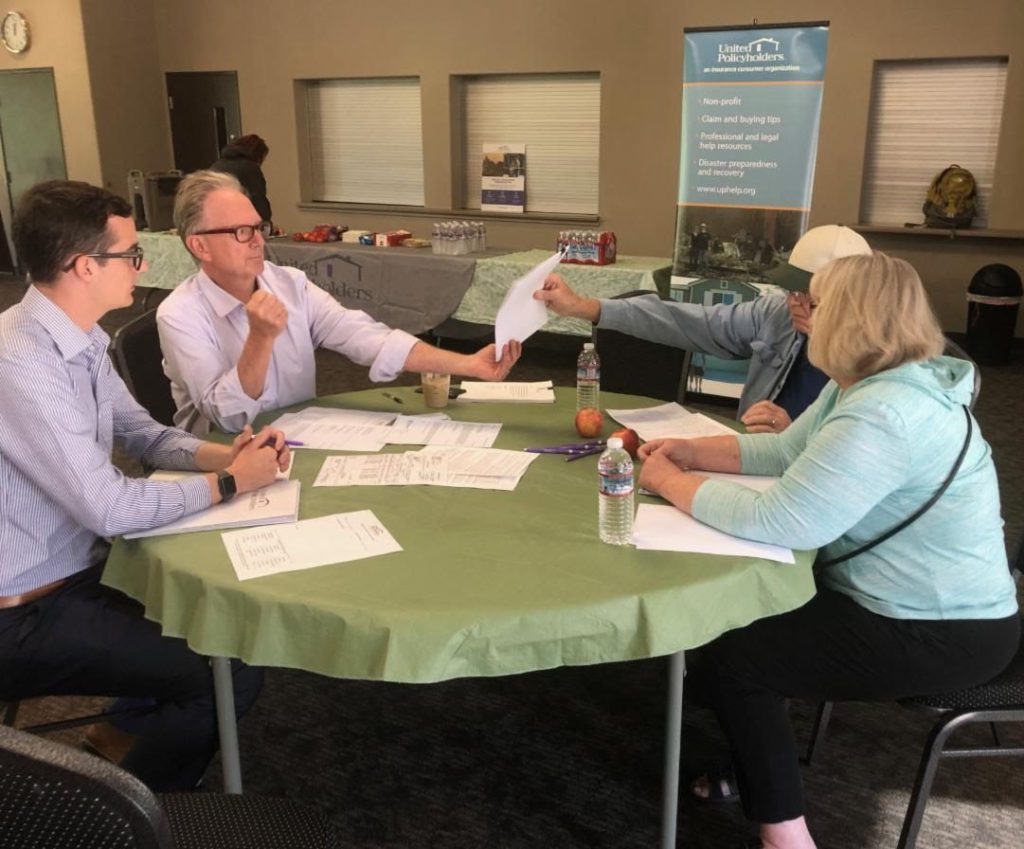

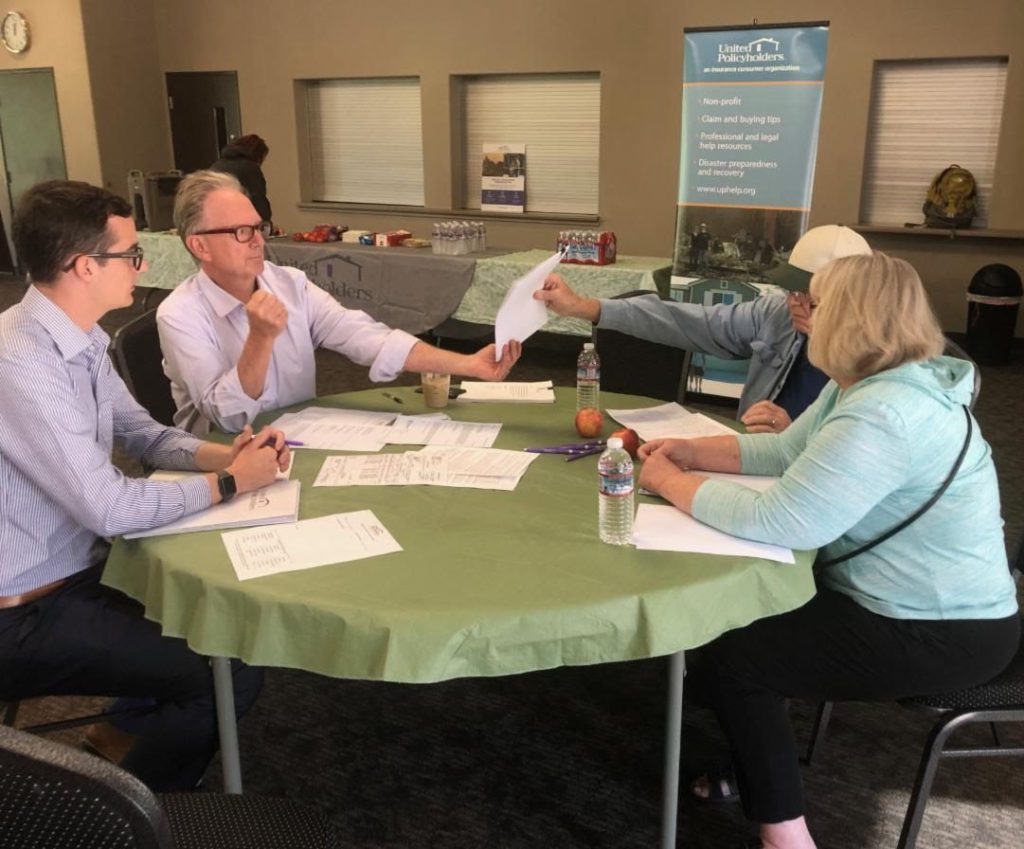

UP clinics give disaster survivors access to free expert legal help that complements what they learn at our workshops.

This year UP and partner organizations hosted free legal help clinics in Northern and Southern California communities. These clinics give disaster-impacted households the chance to have their documents reviewed and questions answered by a Team UP volunteer who specializes in counseling policyholders in coverage and claim disputes.

One attorney described his Team UP clinic volunteer service as “one of the most meaningful experiences I’ve had so far in my law career.” The problems people bring to these clinics inform our advocacy work.

Attorney volunteers also help UP be a powerful advocate for insurance fairness by serving as our eyes and ears and helping draft the “friend of the court” briefs we file in courts across the United States. Our current Amicus Advisory Team includes: John Ellison and Tim Law, (Reed Smith), David Goodwin and Christine Haskett, (Covington & Burling), Dan Veroff (Merlin Law Group) and Jay Rossiter (Perkins Coie).

Thank you Roadmap to Recovery pro bono clinic volunteers:

Covington & Burling

Kantor & Kantor, LLP

Lieff Cabraser Heimann Bernstein

Lesser Law Group

Ken Klein, Esq. (Cedar Fire,’03, Team UP Senior Adviser)

Merlin Law Group

Myers, Widders, Gibson, Jones & Feingold

Perkins Coie

Gary Rose, Esq.

Welty, Weaver & Currie

Teaming UP

Much of our work gets done by volunteers whose experience recovering from a disaster inspired them to engage with UP to help others. UP volunteer Bari Campbell gained an appreciation for our work after losing her home in the Fourmile Fire in Colorado in 2010.

After representing our organization at a Colorado Emergency Management conference earlier this year, Bari shared, “I felt I had come full circle in my recovery process when I had the chance to meet the amazing women and men who help in our disasters.”

Many volunteers were critical in getting our work done this year. We’d like to say a special thank you to the following Team UP volunteers who went above and beyond in 2019 to help us in our mission. We couldn’t do it without you!

Laura Batistich

Dan Carter

Annette and Mike Musson

Steve Price

Karen Reimus

Peter Wassyng

“UP feels like the only entity on our side, helping us to fight for the coverage that we have paid for. Thank you!” – Nicole W., Butte County Wildfire Survivor

L to R: Ventura Supervisor Long, Sonoma Supervisor Gore, UP’s Executive Director Bach and CA Ins. Commissioner Lara came together in November to bring relief to panicked homeowners

UP to the Challenge: Keeping homes insured despite climate risk uncertainty

Most people agree that insurance funds, not charitable or government aid, should be your primary source of funding to repair or replace your home if it gets damaged or destroyed. You’ve pre-paid for that protection and it doesn’t require tax dollars or generosity.

However, insurers efforts to limit what they cover via new exclusions and higher deductibles are eroding insurance as that primary source. UP is working to restore insurance protection integrity through three initiatives:

The Protection Gap Project-Through our engagements with the National Association of Insurance Commissioners and the Federal Insurance Office and various partnerships, UP is advocating for essential coverage standards and more robust risk reduction/mitigation support and rewards. We are conducting research and gathering samples of unfair exclusions and hidden limits via a dedicated email address: policies@uphelp.org. With this information, our partners and we will raise awareness of the hollowed-out coverage trend and (hopefully) inspire competition among insurers to reverse it by offering simplified, essential protection policies.

Match UP-UP is working hard to help the many homeowners who’ve been dropped and are scrambling to find replacement coverage. We are educating the public, lawmakers and the media and partnering with realtors, agents and the California Department of Insurance on big-picture solutions, including temporary moratoriums on non-renewals.

The WRAPP Project (Wildfire Risk Reduction and Asset Protection Project)

-Many states now require insurers to facilitate and reward steps residents take to fortify their homes and reduce disaster risk. But mitigation support and insurance reward programs for wild re risk reduction are almost non-existent, and there is now a full-blown home insurance availability and affordability crisis in many parts of California. UP is working to build a viable mitigation program that will restore consumer options.

An Uncertain Future

UP co-founder Amy Bach was the consumer voice at a national symposium on climate change’s impact on insurance availability and affordability..

The competitive residential property insurance system as we know it seems to be morphing. Insurers are continuing to cut back on what and who they will insure. As a result, government-sponsored programs are growing. There are now government-sponsored insurance programs that sell coverage for flood, earthquake, terrorism, hurricane, and wildfire risk. This is happening because property insurance is not a luxury – it’s a necessity. And it’s not just property owners that are being impacted when insurance becomes impossible to find in the private competitive market. Realtors, lenders, property values, and tax revenues at all levels of government are bearing the brunt of hollowed out and less available coverage. UP and our partners are hard at work advocating for solutions at the state and national level.

A California Governor’s Commission on Catastrophic Wildfire Recovery invited testimony from.CDI’s Joel Laucher, PCI’s Rex Frazier and Bach in May, 2019.

“It has been so helpful to have United Policyholders as an ally. I always learn something valuable at the meetings. I think I would be pretty lost in navigating this process without their help. I feel sorry for those that are not aware of this help or don’t think they need it.” – Lisa K., Butte County Wildfire Survivor

Check UP for insurance assurance:

Blindly trusting an insurer or agent to properly protect one’s home has left two-thirds of disaster victims severely underinsured. To fix this problem, UP encourages people to take action to adjust their policies before they have a loss to avoid the traumatic “surprise.” But it is very hard to find an expert who will review your current policy and advise on whether you’re properly insured but not try to sell you something.

When we learned that our partner, the National Association of Public Insurance Adjusters would be holding a conference in Napa, CA, we recruited conference attendees to volunteer for a UP Roadmap to Preparedness event: A Check UP insurance review clinic.

Instead of spending the afternoon wine tasting or playing golf (not that there’s anything wrong with that…), our volunteers sat down one on one with local residents, reviewed their home policies and made suggestions for tweaks to adequately protect their assets.

Thanks to UP, awareness of post-disaster underinsurance is high in the region, so there were many eager attendees and Check UP was a “sold out” event. Our volunteers were professionals that have coverage and claim expertise but don’t sell insurance. So attendees could rest assured their recommendations were helpful, not profit-oriented.

Thank you to the professional volunteers who reviewed policies free of charge at Check UP:

Jade Bentz

Ken Crown, Gordon Scott (Greenspan North/Adjusters International)

Robert Crown

Rick Ewald

Corey Locke

Dan Veroff

Jahn Miller

Troy Willis

Our expert volunteers reviewed policies and made helpful suggestions to improve disaster-readiness.

Our Nationwide Impact

- 595,000 people used our online resources in 2019

- 585 professionals and disaster survivors that volunteer with Team UP

- 100+ number of times annually UP is quoted in local and national news, including CNN, Wall Street Journal, NPR and The New York Times

- 470 free insurance and disaster recovery publications at uphelp.org

Roadmap to Recovery Spotlight :: Sonoma/Napa 2017 wildfires

- 20+ Educational Workshops / Q and A sessions

- 13 “pro bono” 1 on 1 legal clinics

- 7 Webinars with live Q and A

- 50+ recovery and preparedness events UP participated in

- 300+ “Ask an Expert” questions answered

- 45,000 website views from the impacted areas

- 8,500 visitors to our 2017 North Bay Claim Help Library

Welcome Meghan Gendleman! Meghan, V.P., Enterprise Marketing, Salesforce, recently joined our Board of Directors and is looking forward to supporting the organization’s outreach and education and helping us access pro bono tech resources.

UP thanks and honors the following Board members who completed their service in 2019:

Alice Wolfson: Alice wrapped up nearly two decades of distinguished service to United Policyholders. She has been a Board member, Board Chair, Donor, Advisor and Volunteer. We are deeply grateful to Alice for her extraordinary dedication to helping develop all three of our programs and to serving the interests of insurance consumers. Fortunately for UP, Alice will continue on as a volunteer.

THANK YOU ALICE!!!!

San Francisco based policyholder attorney Terry Coleman is a leading expert in advising and representing insureds in disability, health and long term care disputes and ERISA matters. Terry has assisted in fundraising and will continue to volunteer with UP following completion of his Board service.

Texas based Public Adjuster Jim Beneke has been a liaison between UP and two professional trade association partners (TAPIA and NAPIA), and will continue to serve UP as a volunteer.

Not only have our individual and business sector donations increased, but charitable foundations are appreciating the positive ripple effect of our programs. When insurers feel pressure to pay disaster claims fairly, funds flow better, victims get back on their feet faster, employers get back to business, and there’s less financial strain on local governments. When people use our info to become better informed and insured, they’re more resilient and less dependent on government and charitable resources if adversity strikes. Thank you to all our current supporters:

AT&T

Build UP Sponsors

Center for Disaster Philanthropy

Community Foundation Sonoma County

Entertainment Industry Foundation

“Find Help” business sponsors

Foundation for Financial Planning

Individual Donors

Golden State Finance Authority

Hersher Family Foundation

Napa Valley Community Foundation

North Valley Community Foundation

Rural County Representatives of California

Shippy Foundation

Solano Community Foundation

Sonoma County Community Investment Program

Tipping Point Community’s Emergency Relief Fund

Ventura County Community Foundation

DONATE TODAY