Collecting insurance funds to pay for damage from heavy rains and localized flooding can be tricky.

Insurers have been excluding floods in standard home policies since the 1960s, but the cost of repairing damage from water intrusion due to wind-driven rain, fallen trees, flying debris, sewer and drain backup and drainpipes has traditionally been covered (above your deductible).

In recent years, some insurers have changed the wording in their policies to cap and limit payouts for all types of water and mold damage, and some are even trying to deny claims for damage from wind-driven rain. If your property was recently damaged, visit UP’s 2023 Storm Damage Help library and read UP.

Don’ t take no for an answer until you’ve reported the details of the claim denial to your state’s insurance oversight agency and talked with independent experts about the policy wording and how water got into your home.

Math matters

If your home is damaged but the cost of the repairs is going to be less than your deductible, do your best to dry out your property and find a qualified repair pro, but avoid filing a claim. Every claim you file (even one an insurer denies and doesn’t pay) impacts your insurance risk score. Your insurance score impacts what you pay for insurance, just like a credit score impacts what you pay for credit.

Looking ahead

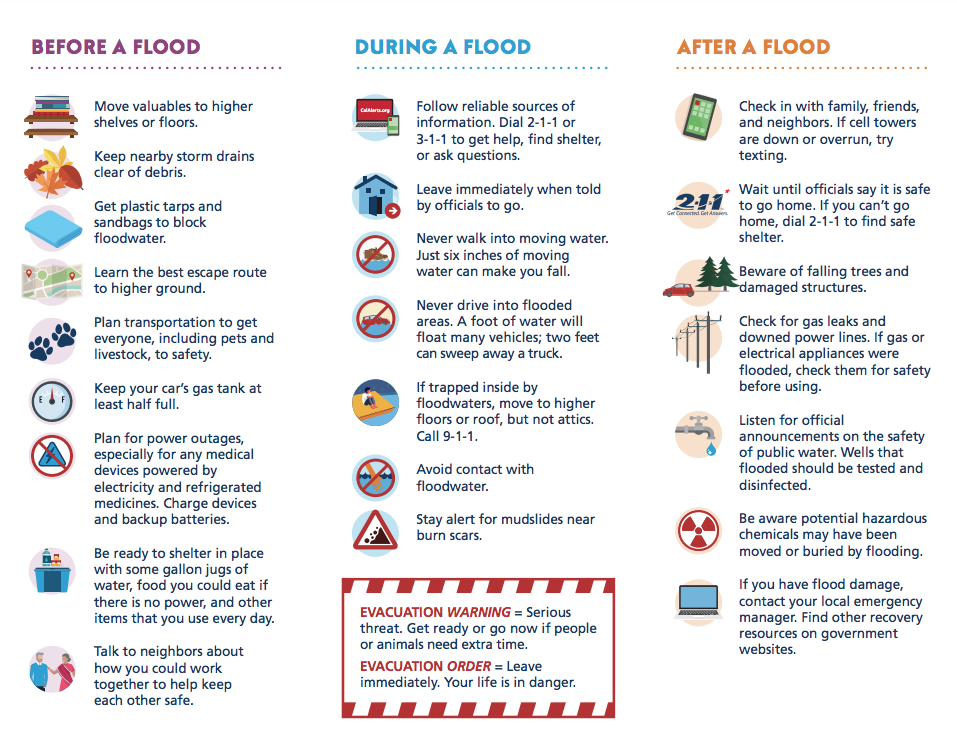

When it rains, place rolled towels up at the base of ground level doors and garages to keep water out, put sand bags in place, and be prepared to pay for repairs out of pocket. Now that we’re seeing how many more people are at risk for flooding, it’s a great idea to get a quote and considering buying flood insurance.