By launching and advancing a “Wildfire Risk Reduction and Asset Protection” (WRAP) initiative in 2017, UP is helping property owners across California keep their assets insured during a home insurance availability and affordability crisis that is affecting many parts of the state. This crisis is hitting people hard in the pocketbook. Insurers have dropped (“non-renewed”) thousands of customers in areas they deem vulnerable to wildfires, and when those customers find a replacement home insurance policy, it provides less protection and costs as much as four times what they had been paying. Not only is this hurting homeowners…it’s reducing property values, hurting real estate sales and causing a ripple effect of economic harm. United Policyholders is working hard with powerful partners to help solve the crisis. We are helping people shop in a very challenging marketplace. We are working to solve the crisis through our WRAP initiative.

Through a combination of advocacy, research and education activities in wildfire-prone states, United Policyholders (“UP”) is a leader in efforts to reduce individual and community level wildfire risk and put insurance rules in place to incentivize and reward those reductions.

When home and business owners in California and Colorado began losing their insurance in 2017 and prices began increasing dramatically, UP launched a Wildfire Risk Reduction and Asset Protection (“WRAP”) initiative. Our first goal was to help establish concensus standards for effective wildfire risk reduction. We accomplished that goal for California in October 2021 when we issued a proposed set of risk reduction standards and shared them with the California Department of Insurance and the Insurance Institute for Home and Business Safety (IBHS). Both CDI and IBHS subsequently issued largely identical standards. We are continuing to contribute to related progress in Colorado, Oregon and Washington as well.

The WRAP group’s next accomplishment was supporting the California Department of Insurance in adopting regulations that require insurers to adjust their rates to reward risk reduced properties and communities. Those regulations were filed with the CA Office of Administrative Law and are now approved. Insurance companies that sell home insurance in California filed updated rating plans to comply with the new regulations. These plans are in the process of being reviewed and revised or approved by the department within set time parameters. The first set of approved mitigation discounts are those filed by the California Fair Plan. To learn more about those discounts and how consumers can qualify for them, see our October, 2023 Home Insurance Briefing webinar recortding and slide deck.

Through our WRAP initiative, we are monitoring pricing and availability in the marketplace in both states by conducting surveys. We are working closely with state insurance regulators and legislators to advance monitoring and remedial efforts, and we have built a network of agent and broker volunteers who serve as additional eyes and ears on which insurers are open for business and where. UP staff is hosting and participating in many consumer-facing education and shopping help events, in-person and online througout the year. Our WRAP Resource Center makes it easy for CA visitors to click on their county and find guidance and mitigation help programs in their area.

One of the most impactful activities under our WRAP initiative is our WRAP working group that consists of public officials, firefighting professionals, community volunteers, scientists, realtors and a range of highly active stakeholders. The group meets monthly to hear from invited experts and discuss progress and problems in the regions of California that are innovating to increase home hardening and defensible space, passing bond measures, hosting grant and technical support programs and putting building codes and other measures in place to decrease risk and increase insurability. We are connecting people in diverse communities with each other and with strategies and program models that are working! UP has hosted over 55 well attended WRAP Working Group meetings to date and after every meeting, attendees send us heartfelt thank yous.

WRAP Working Group meeting speakers have included:

- California’s State Fire Marshall

- Fire Chiefs from counties across CA

- Deputy Commissioners, CA Department of Insurance

- IBHS representatives

- Firewise USA®

- Fire Safe Councils

- Milliman

- CSAA, Mercury Insurance

- Independent Insurance Agents

- Mitigation professionals, inspectors, Product Vendors (Metal gates, Vent Screens)

United Policyholders is helping restore affordable, available property insurance options for home and business owners in wildfire-prone regions. Our focus is on helping people and communities invest in wildfire risk reduction to prevent damage and destruction and be able to keep their properties insured at reasonable rates. Our work includes helping property owners access expertise and financial resources for hardening homes and creating defensible space and advancing policies that will reward risk reduction and bring insurers back into zip codes where they’re no longer offering new or renewal policies. Our WRAP initiative has been focused on California, but we’re doing related work in Colorado and Oregon as well.

Data on property vulnerabilities and increased wildfire risk due to drought and extreme heat associated with climate change is causing insurance companies to dramatically reduce property insurance sales in Wildland Urban Interface areas, suburban and even urban regions throughout Western states. Insurers are dropping long time customers, declining new business and increasing premiums. This is making it very hard for home and business owners to keep their assets affordably or fully insured and comply with lender requirements.Reducing wildfire risk is critical to fixing this situation. Improving conditions so structures and communities are less likely to be damaged or destroyed in future wildfires will help restore insurer confidence and engagement and save homes!

UP is committed to helping establish incentives and rewards for those who invest time and money into risk reduction. Giving property owners a financial incentive (cheaper, more accessible insurance) to spend money and time on property improvements will increase parcel and community level mitigation, should restore insurer confidence and competition, and lead to appropriate discounts for reduced risk.

Now that standards and a set of regulations are in place in California, and Colorado has adopted a statewide WUI Building Code, our next goals are:

- Continuing to educate and support property owners on reducing risk and shopping for insurance.

- Monitoring insurance company compliance with the new regulations.

- Helping build out programs to provide financial and hands-on help with limbing trees, clearing brush, screening vents, boxing eaves, removing hazardous conditions and replacing class B roofs with class A roofs.

- Ongoing communication with insurance company representatives aimed at increasing renewals and new policy sales.

Thanks to United Policyholders’ staff, volunteers and partner network, grants from the California Office of Emergency Services, and the Argosy Foundation in Colorado, we are well on our way toward meeting those goals!

-

About the WRAP Initiative

-

Approach

- Help homeowners keep their assets insured despite the affordability and availability crisis

- Identify the most commonly accepted home improvements that experts and communities are promoting to facilitate home hardening and fuel reduction steps (see below)

- Advocate with the CA Dept. of Insurance and in the CA legislature to establish an official fire risk reduced home standard, financial assistance, inspection and certification program.

- Advocate that CDI and other state insurance regulators continue to limit the use of predictive models in home insurance rates.

- Continue our work at the federal level advancing mitigation and insurance support/reward programs across the country

- Collect data through our ongoing California Home Insurance Survey

The following list identifies effective means for protecting a dwelling from wildfire loss. The list is not an exhaustive catalogue but is a focused compilation, created through United Policyholders “WRAP” initiative, of the key recommendations from an array of experts in residential wildfire risk reduction.

United Policyholders is encouraging all insurers to expand eligibility for coverage and to offer discounts in recognition of the reduced risk presented by homes that have incorporated these mitigation measures.

-

WRAP Mitigated Dwelling Measures

Roof

· The dwelling has a well-maintained Class A roof. Where gutters are present, the roof includes a metal drip edge.

· For homes with metal or tile roofs, gaps greater than 1/8 inch between roofing and sheathing have been blocked to prevent debris accumulation and ember entry.

Vents

· Exterior vents (e.g., foundation, gable, under eave, and roof vents) incorporate a 1/8 inch metal mesh or are designed for flame and ember resistance (Wildland Flame and Ember Resistant (WUI) vents approved and listed by the California State Fire Marshall or WUI vents listed to ASTM E2886).

Fences

· Any wooden fences that attach to the dwelling structure shall incorporate only noncombustible materials (fencing or gating) in the last 5 feet before the attachment point(s) to the structure.

Decks

· All combustible materials (e.g., grass, shrubs, or stored materials) must be removed from underneath attached wooden decks or stairways and maintained at least 5 feet away from the decks’ or stairways’ perimeters.

Other Attached Structures (arbors, pergolas, trellis)

· Any other structure that is attached to the dwelling structure must be made of noncombustible materials.

Buildings less than 25 feet from the Dwelling Structure or Attached Decking

· If another structure (e.g., a dwelling, garage, barn, shed or commercial building) is within 25 feet of the dwelling, the dwelling’s exterior wall that faces the nearby structure meets a one-hour fire rating and includes noncombustible cladding.

· Where windows face the nearby structure, the windows either include dual-paned glass with at least the exterior pane is tempered glass or the windows have deployable metal shutters.

Defensible Space and Landscape

· There is at least 6 inches of noncombustible clearance between the ground and the exterior siding of the dwelling.

· Within the first 5 feet of any dwelling or attached decks, no combustible materials (e.g., woody plants, combustible mulch, stored items) are present around the building or deck(s)or below the deck(s).

· For the landscape from 5-30 feet from structure (or property line if closer), the connectivity of vegetation leading to the dwelling structure has been eliminated. The lower branches of trees have been limbed up at least 6 feet above underlying or adjacent shrubs to eliminate fuel ladder connectivity. The landscaping is irrigated and maintained. Vegetation may be grouped and surrounded by areas of irrigated and mowed grass or hardscaping.

· For the landscape from 30-100 feet from the structure (or property line if closer), there is separation between shrubs and trees, dead branches and leaves have been removed, lower branches of trees are pruned to curtail the spread of fire and to eliminate fuel ladders.

· For dwellings on or adjacent to steep slopes (e.g., slopes greater than 35 degrees), landscape mitigation has been extended downslope and beyond the 100 feet perimeter, where possible, to reduce direct flame contact with or preheating of the dwelling or the underside of any decking.

View as a PDF: WRAP Working Group Mitigated Dwelling Measures (October 2021)

-

IBHS Wildfire Prepared Home

on June 22, IBHS officially launched Wildfire Prepared Home™, a wildfire mitigation designation program. Grounded in a decade of IBHS wildfire research, Wildfire Prepared Home allows homeowners to show they’ve taken the suite of science-based actions needed to meaningfully reduce their home’s wildfire risk, distinguishing it from partially or unmitigated properties.

Wildfire Prepared 2022 Homeowner Guide

Construction Costs for a Wildfire-Resistant Home (July 2022)

-

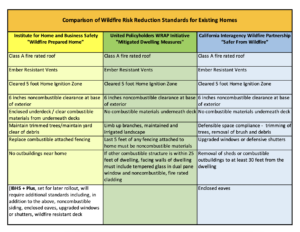

Comparison Chart: WRAP / IBHS / CA Wildfire Partnership

Comparison of WRAP Initiative’s “Mitigated Dwelling Measures” with the Institute for Home and Business Safety’s “Wildfire Prepared Home” and California Interagency Wildfire Partnership “Safer from Wildfire” standards.

Wildfire Risk Reduction and Asset Protection Working Group Speakers and Participants (partial list)

|

Local and State Entities Supervisor Rosemarie Smallcombe, Mariposa County Town of Paradise, Recovery and Economic Development Department Michael Martinez, Mike Peterson, Claudia Mildner, California Department of Insurance California Association of Realtors Staci Heaton, Rural County Representatives of California Mark Brown, Marin Wildfire Prevention Authority Firefighting Professionals Bill Tyler, Fire Safe Marin (formerly w.Novato Fire District) Jordan Villagomez, Deputy Fire Marshall, Encinitas Fire Monterey County Regional Fire District California Department of Forestry and Fire Protection Western Fire Chiefs Association CalFire Research Professionals Michael Newman, Anne Cope, Evan Sluder, Insurance Institute for Business and Home Safety Dan Gorham, Institute for Home and Business Safety Dan Turner, Cal Poly WUI FIRE Institute Marc Horney, Cal Poly Yana Valachovic, University of California Cooperative Extension Michele Steinberg, Wildfire Division Director, NFPA Megan Fitzgerald-McGowan, Firewise USA® Program Manager, NFPA Michael Gollner, PhD. Univ of California, Berkeley |

FireSafe Councils and FireWise Community Advocates California Fire Safe Council Ventura Regional Fire Safe Council COPE (Citizens Organized to Prepare for Emergencies) Jim Webster, Wildfire Partners (CO) Greater Auburn Fire Safe Council Mary Schreiber, Fire Safe Council East Orange County Canyons Mt. Veeder Fire Safe Council Mariposa Fire Safe Council Modoc Fire Safe Council Oakland Fire Safe Council Pacheco Valley Firewise Committee Placerville Fire Safe Council Scripps Ranch Fire Safe Council Silverado Fire Safe Council SWRC Fire Safe Council Topanga Canyon Fire Safe Council Mitigation Products and Vendors Steve Rahmn, Firebrand Safety Systems, Inc. Brent Berkompas, Brandguard Vents Ivan O’Neill, Madronus Wildfire Defense Katherine Rogers, Durabond Fencing Wildfire Modeling Professionals Frederick Dupe Fortier, Zesty AI Tammy Schwartz, Black Swan Analytics Nancy Watkins, Milliman |

If you are interested in joining the Wildfire Risk Reduction and Asset Protection Project Working Group, email: Emily.Rogan@uphelp.org

Consumer Help Information

- Dropped by your insurer, where to go for help

- The lowdown from UP on the California FAIR Plan, the last resort option for insuring your home

- UP Webinars: Shopping for Insurance in a challenging marketplace

Updates on the Affordability and Availability Crisis

- UP and WRAP partners testify before Congress on insurance challenges and progress in wildfire-prone states

- CDI Regulations Moving Forward (Sept 2022)

- UP Launches WRAP Working Group (2020)

- UP Petitions for Wildfire Insurance Investigation (Oct 2017)

- Wildfire Risk Reduction and Insurability (Jan 2017)

- Climate Change and Insurance

Reports and Bulletins

- Mandated vs. Voluntary Adaptation to Natural Disasters: The Case of U.S. Wildfires NBER report found homes that are built to the state’s latest wildfire building codes are about 40% less likely to burn down in a fire, and that when a home is built to wildfire code it also improve the odds of the homes right around it surviving, too. But the researchers also found few people are voluntarily upgrading existing homes. (Dec 2021)

- Commission of Catastrophic Wildfire Cost and Recovery Final Report

- Department of Insurance White Paper on Availability/Affordability

- Commissioner predicts shrinking insurance options for CA homeowners

- California Department Of Insurance Echoes Black Swan’s Call For Transparency In Wildfire Risk Assessment

Data / Survey Results

- 2022 California Home Insurance Survey (closed)

- 2019 California Home Insurance Availability Survey (closed)

- 2017 California Home Insurance Survey (report)

- Examples of mitigation standards

-

Examples of local mitigation and certification programs

- California Wildfire Mitigation Program

- Dulzura area homeowners in San Diego County (91917)

- Whitmore area homeowners in Shasta County (96096)

- Kelseyville-Riviera area homeowners in Lake County (95451)

- Wildfire Partners

- Marin Wildfire Prevention Authority

- Fire Safe Council of Nevada County

- Ventura Regional Fire Safe Council

- California Wildfire Mitigation Program

- Example of Insurer Rewards

-

Examples of Products and Services to "Harden Your Home"

- CalFire STATE FIRE MARSHAL LISTED WILDLAND URBAN INTERFACE (WUI) PRODUCTS HANDBOOK (12/2022)

- Topanga Canyon Fire Safe Council Home hardening Products List

- Guest Blog: Fire resistant structures from the ground up, a technology making inroads in disaster affected areas

- Guest Blog: Fire Resistant Building Materials for New Home Construction

- Examples of inspection forms

-

California

- California Code of Regulations § 2644.9. Consideration of Mitigation Factors

- CDI Data and Analysis on Wildfires and Insurance

- UP Testimony/Comments Before the California Department of Insurance re:

Mitigation in Rating Plans and Wildfire Risk Models: REG-2020-00015, April 12, 2022 - Board Letter regarding Insurance Proposal

- UP Testimony/Comments Before the California Department of Insurance re: Mitigation in Rating Plans and Wildfire Risk Models, REG-2020-00015, November 10, 2021

- HR 5494 – Catastrophe Loss Mitigation Incentive and Tax Parity Act of 2019

- AB 2367 (CA 2020) – Letter of Support

- AB 2167 (CA 2020) UP Assembly Letter of Opposition, UP Senate Letter of Opposition

- Template AB 2167 Letter of Opposition

- Consumer Federation of California AB 2167 Letter of Opposition

- Consumer Federation of America Actuarial Opinion Concerning AB 2167

- Consumer Watchdog Letter to Senator Atkins Re: AB 2167

- Article: Watchdog group opposes bill that would hike insurance rates in fire-prone areas

- Senate Bill Analysis

- Assembly Bill Analysis

- UP Updated Letter of Opposition to the Senate Committee on Appropriations

- LA Times – Editorial: An insurance fix for fire-prone areas that only an insurance company could love

- Sacramento Bee – California state legislators use coronavirus as an excuse to hijack democratic process

- SB 292 (CA 2020) – Letter of Opposition

- Wildfire Safety and Recovery Act – SB 824

- Joint Legislative Committee Emergency Management and Senate Committee on Insurance Informational Hearing, March 20, 2018

- Governor’s Tree Mortality Task Force (2016-2017)

-

Other State Legislative/Regulatory Efforts

- Guiding consumers through current home insurance affordability and availability challenges – NAIC 2024 Spring Meeting

- When private options shrink for insuring property … Residual market entities and consumer challenges 12.2021

- NAIC Research Report: State Actions_Insurance Discounts and Credits 2.4.20

- NAIC Presentation: State approaches to facilitating mitigation: Standards, mandates, incentives and help (Aug 2017)