A message from Co-Founder and Executive Director, Amy Bach

We are proud to bring you our 2020 What’s UP newsletter. This expanded version of our print mailer features updates on what’s ahead in 2021 and the latest from your ever-dedicated Team UP.

Dear Friends,

As the most challenging year in many people’s lifetimes draws to an end, I could not be prouder of Team UP or more grateful to our donors and volunteers.

We haven’t missed a beat during COVID:

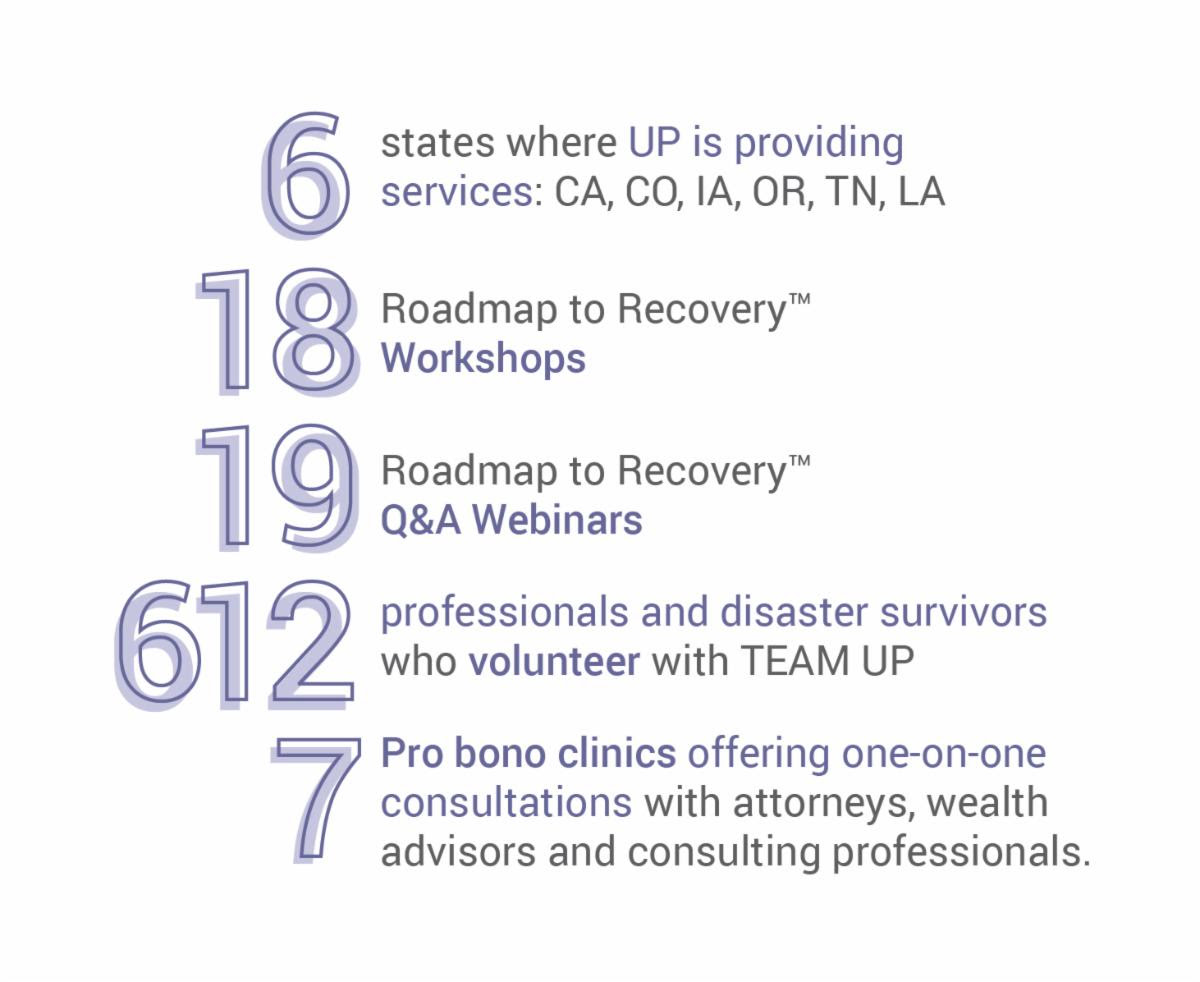

- We are running disaster recovery operations in CA, OR, IA and CO and doing resiliency/preparedness outreach and education in CO and CA.

- We are advancing important national and state initiatives to restore insurance safety nets, help businesses survive the pandemic and create financial incentives for making home improvements that reduce risk.

- We’ve hosted more workshops and webinars in 2020 than in any prior year.

- Our pilot virtual pro bono legal help clinic for wildfire survivors was so successful and convenient for volunteers and survivors- we are now planning online financial and tax help clinics early in the new year. We even held two online FUNdraisers.Turns out operating virtually has increased United Policyholders’ productivity! That means our base of financial support has to grow too. Please support UP and share our website link with friends, family and co-workers: uphelp.orgThe vaccine is cause for optimism, but so is the fact that so many people are willing to give their time and expertise, with no compensation, to help strangers and improve disaster recovery and resilience by volunteering with our organization.May we all thrive in 2021, thank you Team UP.

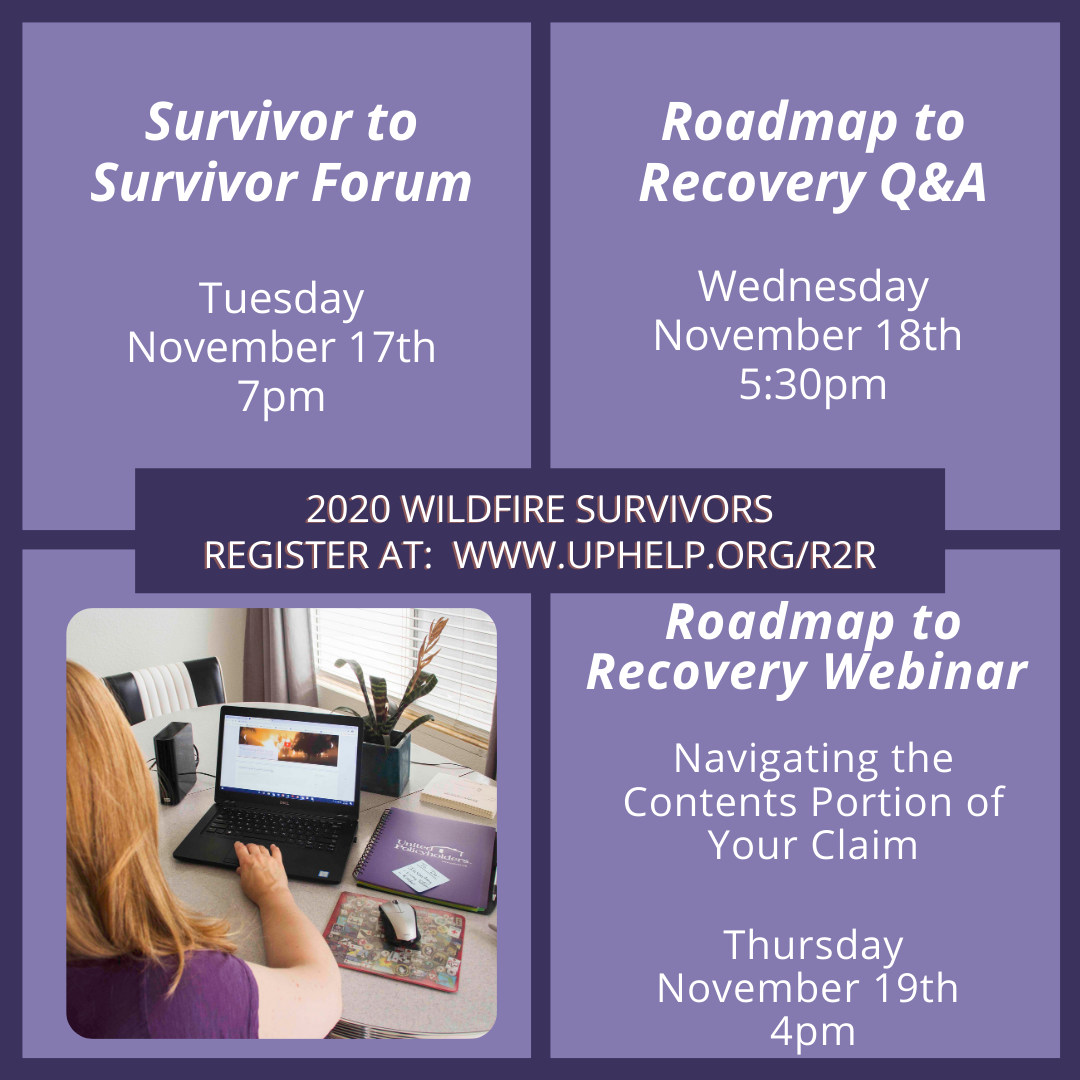

- Roadmap to Recovery

- Advocacy and Action

- Roadmap to Preparedness

- UP in the News

- Thank you Donors and Funders

Post-disaster tools and guidance focused on restoring financial health

Among 2020’s unwanted gifts were hurricanes, tornadoes, a derecho and record-breaking wildfires. Thanks to generous support from funders including the Center for Disaster Philanthropy, the California Community Foundation and individual donors, UP is serving impacted households in virtually every region.

In addition to curating disaster-specific libraries, we deployed staff to assistance centers and are running virtual Roadmap to Recoveries featuring our usual expert and empathetic guidance in collaboration with local partners in six states.

In addition to the technical information UP offers on a wide range of insurance, construction, personal finance, legal and tax matters, we also provide emotional support and a special kind of encouragement.

Encouragement that comes from our disaster survivor volunteers who’ve “been there done that.” Helpers who are living proof that one can make it through and thrive again, laugh again, and even find the occasional silver lining.

The Roadmap to RecoveryTM support we bring to people who are recovering from devastating losses includes inspiration and insights that make it easier to deal with insurance and other frustrations and keep moving forward toward restoring a life that has been shattered by profound loss.

“The Roadmap to Recovery Program helped us find our way through the nightmare of losing our home of 30 yrs…The knowledge we gained at the meetings as well as the one-to-one sessions was extremely valuable. The caring, professional way in which United Policyholders personnel & volunteers treated us will never be forgotten. My family & I sincerely thank you from the bottom of our hearts.” – Joseph D. & family (2017 Tubbs fire survivors)

Local R2R Coordinators Step UP

2020 saw a major enhancement to our Roadmap to RecoveryTM program thanks to grant funding that allowed us to hire Local Recovery Coordinators in four wildfire-impacted regions. Having a local in the impacted community working directly with survivors, our professional staff and our Long Term Recovery Group partners is so valuable, and we will continue seeking funding to make that a permanent Roadmap to RecoveryTM feature.

Survivors Inspiring Survivors

We strive to give people inspiration, hope and ideas from other fire survivors who are ahead of them on the road to recovery. So we were disappointed when Shelter in Place orders cancelled the in-person visits we’d arranged for 2018 Woolsey/Hill survivors to see rebuilt 2017 Thomas fire homes in Ventura County only a week before our highly anticipated Roadmap to RecoveryTM event. We quickly regrouped. Working with 2017 Thomas Fire family volunteers, their builders, and architects, UP created a series of three virtual house tours with useful info and strategies on plans, permitting, and rebuilding and the various stages of the construction process. The virtual tours were a hit!

Before: A 2017 Thomas wildfire destroyed home // After: Rebuilding nearly complete in 2020

Protecting Reasonable Expectations

We work toward that goal through our staff’s advocacy work in legislative and court matters and as an official consumer representative at the National Association of Insurance Commissioners and on the Federal Advisory Committee on Insurance. The information we get directly from consumers, volunteers and partners keeps us up to date and well-positioned to advocate for insurers to meet policyholders’ reasonable expectations of coverage.

This year’s highlights:

- Helped enact legislative reforms that expedite insurance benefits for temporary rent, replacing essential items and that make it easier for total loss victims to replace their homes by moving out of harm’s way without leaving insurance funds on the table.

- Launched and secured a major underwriter for a national initiative (RISC) to counteract the trend of insurers’ raising deductibles and adding exclusions that hollow out coverage and undermine essential financial protection for property damage. Thank you Chip Merlin and Merlin Law Group for so generously helping underwrite the RISC project.

- Advocated that State and Federal public officials and judges hold insurers’ accountable for paying covered business interruption claims.

- Made significant progress toward establishing the nation’s first statewide wildfire risk reduction and insurance reward program through our WRAP initiative. Secured support for the initiative through the Resilience Challenge, SDG&E and the San Diego County Office of Emergency Management.

- Helped secure favorable outcomes for individuals and businesses in claim and coverage litigation battles by filing Amicus Curaie briefs

- Successfully opposed an insurance industry lobbying effort in CA to weaken home insurance rate increase limitations.

COVID-19 Loss Recovery Initiative

Just as we help and guide individuals impacted by large-scale disasters, we are helping businesses assert their right to Business Interruption, Event Cancellation and Civil Authority benefits to riscstay afloat and resume operations when it is safe to do so.

Our COVID-19 Loss Recovery Initiative includes:

- Partnering with business associations to educate their members and help them advocate for fair treatment by insurers.

- Presentations to State Insurance Regulators through the National Association of Insurance Commissioners.

- An Advisory Work Group that includes many of the nation’s most experienced and prominent insurance recovery/policyholder attorneys.

- Preparing and filing friend of the court (amicus) briefs to help courts reach fair results in litigation initiated by businesses whose insurers rejected their claims, often without adequate investigation.

- A curated library featuring scholarly articles, legal briefs and news updates.

The prospect of having to pay out on COVID-19 business losses triggered a panic among insurers, and they responded with a powerful nationwide public relations and lobbying campaign. A campaign to convince regulators, courts, the public and their own customers that they don’t and won’t cover any COVID-19 business losses, despite the fact that they collected premiums for insurance specifically labeled as “Business Interruption” coverage. According to insurers and their trade associations, they don’t cover any virus-related losses and never have. That is just not true.

There are two main problem with insurers’ position: First, insurers did pay hotel cancellation losses due to SARS. So, there is a real question whether insurers were candid with their customers when they added virus exclusions after SARS and told regulators there was no rate reduction needed because the exclusion was merely a clarification. Second, if ever there was an event that interrupted businesses…it’s COVID-19.

To the members of our national Working Group and our volunteer amicus brief writers for this initiative to date – THANK YOU for sharing your time and expertise to help UP fight for what’s right for insured, interrupted business owners.

|

|

“UP is critical in the work we are doing (in the California legislature)…Thanks to help from UP, we were able to streamline the claims process (for disaster victims), get additional rights to homeowners, we extended ALE… We got more transparency for consumers, and we are going to continue to build on these rights.”– California Insurance Commissioner Ricardo Lara

Restoring Insurance Safetynets Coalition:

A UP Initiative and a National Imperative

After making repeated presentations on this topic to regulators and lawmakers, UP recognized the need for a national stakeholder coalition to tackle the situation. When insurers reduce coverage for roof repairs, it’s not just their customers who get hurt. Lenders, roofers, local government and neighbors suffer. So we have launched an initiative branded “RISC” (Restoring Insurance Safetynets Coalition).

We are documenting this serious situation and pursuing an advocacy agenda to reverse the gutting of coverage. We will be spotlighting examples of harmful exclusions and advocating for the enforcement of consumer protections to restore the insurance safety nets that people count on and believe they’re paying for when they pay home insurance premiums.

We will be issuing a RISC report in 2021 to educate policymakers, the media, and the public about the economic harm that results from unexpected coverage gaps. We will be advancing solutions via regulatory, legislative and consumer education proposals. RISC is a national imperative.

Want to help restore disaster safety nets?

Submit examples of unfair exclusions to policies@uphelp.org, donate on our website here.

Special thanks to Holly Soffer, Nancy Dominguez, and Sarah Parker for participating in our RISC Working Group.

Tips and tools to help people build financial safety nets for disaster resiliency

Helping Keep Homes in Wildfire-Prone Areas Protected

Similar to how insurers withdrew from the Florida home insurance market after multiple hurricanes in the 90’s, many have dropped their California customers due to multiple wildfires in recent years or added surcharges that make the policies unaffordable. Colorado residents are likely to be facing similar challenges to keeping their homes insured in the near future due to the 2020 fires.

UP is working to help consumers in all wildfire-prone states shop smart, navigate current home insurance options and take steps to reduce risk. Thanks to two government grants (US Homeland Security Urban Area Security Initiative and Listos, California), we have been helping vulnerable homeowners and renters in ten Colorado counties and in San Francisco County be properly insured and resilient.upjoins

Photo above: Novato, CA Fire Chief Bill Tyler spearheaded a successful bond measure that is financing brush clearing and fire risk reduction and is an important part of UP’s WRAP initiative (see below).

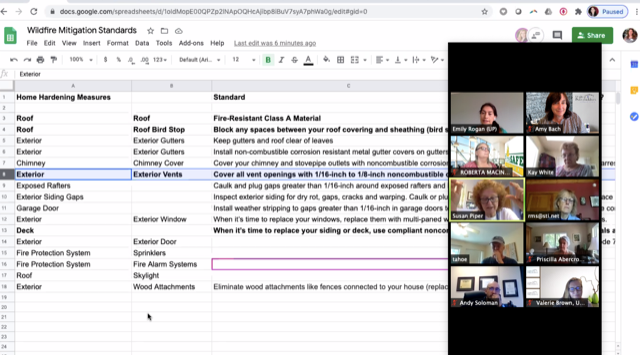

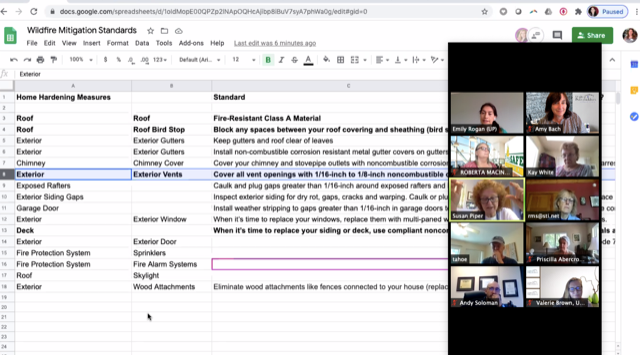

In 2020 we launched an initiative branded as WRAP (Wildfire Risk and Asset Protection) through which UP staff, firefighting professionals, public officials and community-based fire prevention volunteers are working to establish a statewide mitigation support and reward program.

Photo above: A home improvement/wildfire risk reduction checklist being created during a WRAP meeting with Mariposa County Supervisor Rosemarie Smallcombe, fire prevention advocates Sue Piper, Priscilla Abercrombie, and others.

Photo right: UP joins federal, state and local officials as a source of national recovery expertise.

We’re educating consumers through free online UP webinars and by participating on speaker panels during town halls hosted by Insurance Commissioner Ricardo Lara, and events organized by realtor and other trade associations.

To help those who are having trouble keeping and finding affordable home insurance in California, UP is taking a similar approach to what we did for Florida, New York and Massachusetts residents over a decade ago.

We are finding pro-active, pro-consumer agents who can access more options than those who can only sell one insurer’s products. We have revived a version of the “Match UP” program we’d set up in 1992 that connects consumers with independent agents. To date this service has helped over a thousand CA homeowners keep their homes insured.

We published new guidance on how to shop after your insurer drops you, and options available through California’s insurer of last resort, the CA Fair Plan.

Tips from the Trenches

UP knows what matters when it comes to insurance. Some insurance problems are so difficult to solve after disasters. That’s why we pass along our insurance expertise coupled with lessons learned the hard way from disaster survivors to help people make sure the safety net they think they have is there if/when they need it.

We help people become savvy and smart consumers when it comes to insuring your biggest asset: your home…all from the comfort of your home (via Zoom). Learn more here

Photo: Installing vent screens is an inexpensive way of reducing wildfire risk.

Seasoned non-profit professional Val Brown joined us full time, bringing decades of expertise in management, disaster recovery and social services delivery and an outstanding work ethic.

Photo above: Val Brown (back row) with Tzu Chi USA friends

Veteran Insurance Regulator Joins Team UP

We are very pleased to welcome Joel Laucher as a Program Consultant to United Policyholders. Joel brings over 35 years of experience in insurance rates and policy matters with the California Department of Insurance.

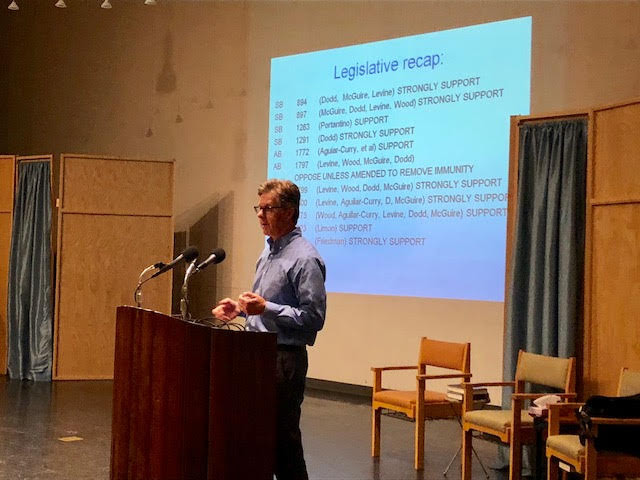

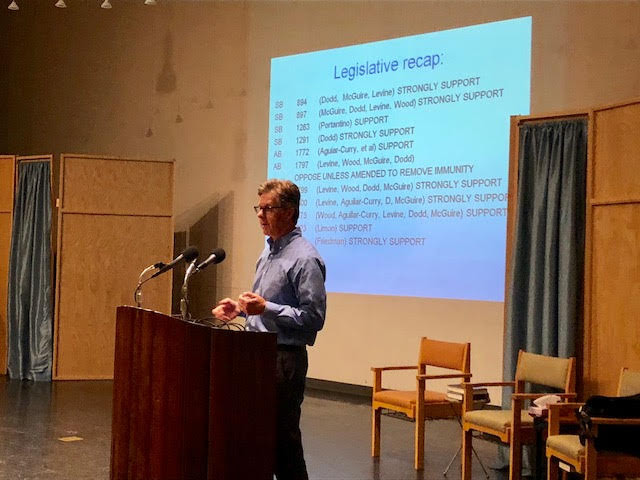

Photo above: Joel Laucher at a UP Roadmap to Recovery workshop pre-COVID

Photo above: UP Staff, December 2020

Board Members Step UP

Case in point: Eileen Freiberger (pictured above covering UP’s table at a post-wildfire Local Assistance Center) joined our Board in 2020 and helped out at numerous events throughout the year.

Board members Nic Casagrande, Jennifer Rosdail and Pamela Schmitz completed their terms of service this year, and we’re so grateful for their expertise, time and financial support.

The emergence of a global pandemic did not change our dedication to helping disaster survivors get back home, provide disaster preparedness education, and advocate on behalf of insurance policyholders in all 50 states.

Thanks to our supporters and volunteers, 2020 was one of the most impactful years in our 29-year history.

Special Mentions

Thanks to support from our foundation partners, Find Help sponsors, event sponsors, and our individual and corporate donors, UP expanded the services we provided in 2020.

Non profit partners

- American Red Cross

- Business Interruption Group

- Consumer Federation of America

- Consumer Federation of California

- Consumer Watchdog

- Fired Up Sisters (holiday notes and giftcards)

- National and Regional VOADs

- National Independent Venue Association #saveourstages

- Out of the Ashes

- Salvation Army

- Up from the Ashes

Donors who helped us deliver 1,000 Disaster Recovery Handbooks in 2020

- Scott DeLuise

- Richard Mazees

- Chris Rockers

- Anonymous (San Diego)

UP to Good and UP to (more) Good

VIP friends included CA State Treasurer Fiona Ma, Chef Thomas Keller (pictured, above), CA Insurance Commissioner Ricardo Lara, David Pogue, John Houghtaling, Chip Merlin, Franco Valobra, along with our great friends, supporters and energetic auction bidders!

We couldn’t have gotten up to so much good without the support of our event sponsors and auction item donors:

Abacus Wealth Partners, Butter& Bakery, CloudFast LLC, Covington, Crown Adjusting, Doug Wertheimer, e2Value, Harlan Estate, Jennifer Rosdail Real Estate Sales, Kantor & Kantor, LLP, Kerley Schaffer, LLP, Lesser Law Group, Lieff Cabraser Heimann & Bernstein, LLP, Liquid Alchemy, Merlin Law Group, Raizner Slania LLP, Reed Smith, Salesforce, Susan Piper, Tom Eddy Winery.

Thirsting for great California wines?

Check out Wine Country Connection, let them know you’re on Team UP!