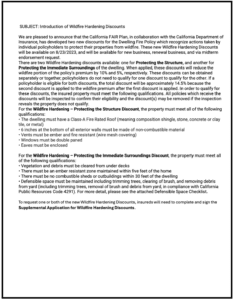

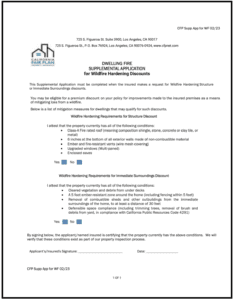

Welcome to the Wildfire Risk Reduction and Asset Protection (“WRAP”) Resource Center, a United Policyholders’ initiative supported by a statewide network of resiliency advocates and the Governor’s Office of Emergency Services.

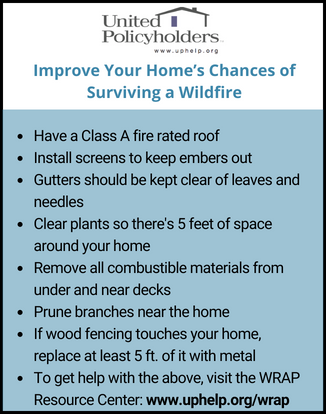

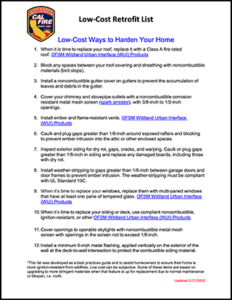

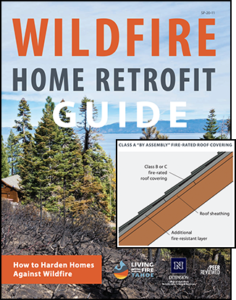

Our goals are to reduce wildfire risk throughout California and help property owners access fairly priced insurance. In this WRAP Resource Center you’ll find out about the home improvements that reduce wildfire risk, access leads to programs and people that can help you make those improvements, and info on risk reduction activities in your community. Let’s get started!